Norway’s fishing industry is a major sector in the country’s economy and is relied on internationally, as Norway is the second largest global exporter of seafood (by value).

Plastic has been a key enabler for the industry’s growth, thanks to its low cost, malleability, resilience, and durability. But its negative impacts are less well known, including its leakage into nature, which has a greater direct effect on marine life than plastic leakage by other sectors through entanglement during ‘ghost fishing’, smothering, and other threats. In Norway, both fisheries and aquaculture firms have started to recognise the importance of moving towards a more circular plastic system and momentum is building. Research and pilots are already taking place both upstream and downstream but a robust EPR policy, constructed in collaboration with all actors in the value chain, will be key to accelerating the transition to a more circular system.

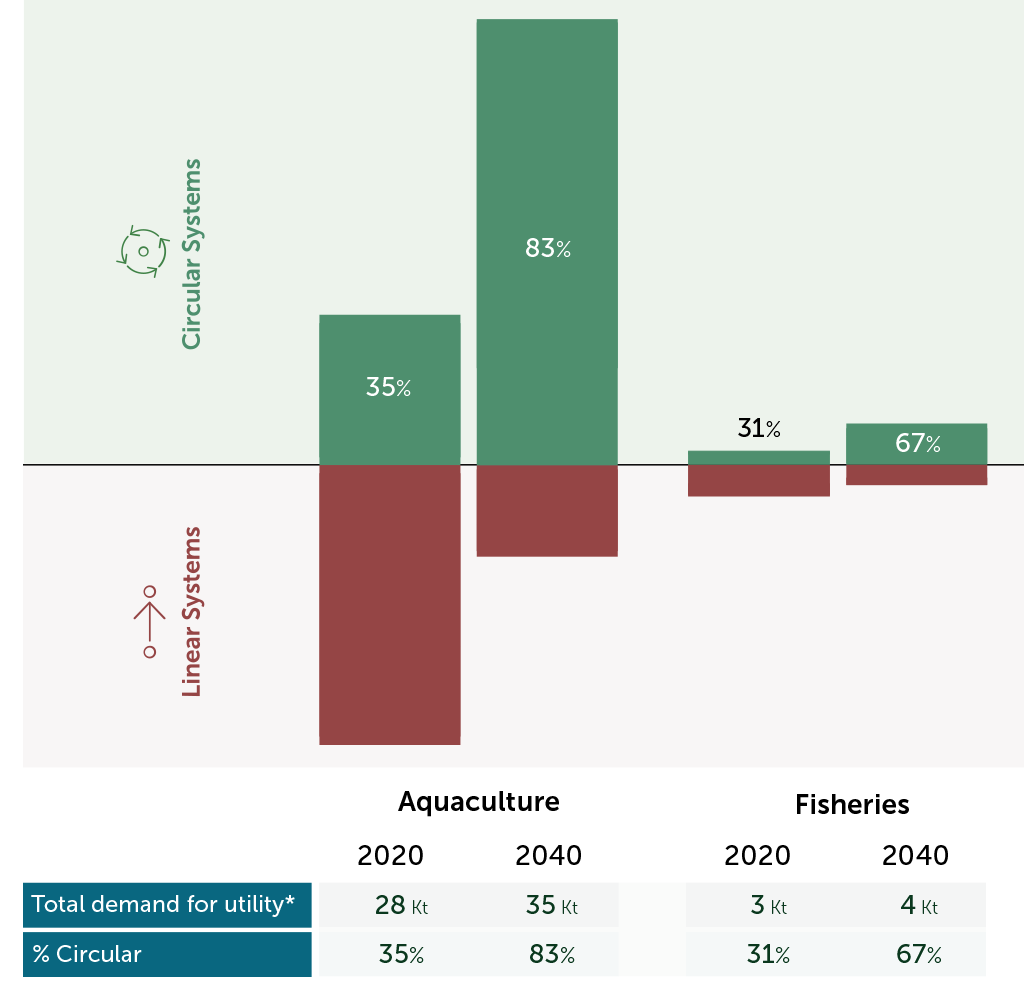

Our analysis shows that the demand for virgin plastics in fisheries and aquaculture can be reduced by ~16,000 tonnes (~48%), and the sector shift from 35% to 81% circularityp, by 2040. As a result, total yearly GHG emissions related to this sector decrease from ~114,000 tonnes of CO2eq to ~51,000 tonnes of CO2eq by 2040 (Exhibit 24).

EXHIBIT 24

Potential outcomes of implementing a System Change Scenario

Baseline:

Momentum is building for a more circular system

While plastic demand per tonne of fish caught has been stabilising for both fisheries and aquaculture, annual demand for plastics utility is still increasing (expected to rise by ~27% between 2020 and 2040), driven by production growth31.

Plastic makes up ~70% of the weight of all gear used (45% for fisheries, 73% for aquaculture)11. Fishing capacity has already gone through a restructuring phase and gear has now stabilised at ~9 kg of plastic/tonne of fish. In aquaculture, efficiency of plastic use is expected to show a slight improvement, driven by the move to larger offshore farms and the use of closed cages on onshore farms, before stabilising at ~117 kg of plastic/tonne of fish by 2030, highlighting the fact that aquaculture is far more plastic intensive than fishing.

Even though Norway is a frontrunner in plastic management in this sector, and there are many promising circularity pilot projects ongoing, the current system is still highly linear, with 66% of plastic waste currently incinerated, landfilled or leaked into nature.

Today, ~42% of total waste is incinerated, ~21% landfilled, and ~2% leaks into natureq. Only ~33% of total waste is currently recycled, though this has been increasing over the last years. The majority of this recycled material flows to other sectors, but a small proportion of components are reused after gear has been discarded (~2%). However, it is important to note there is a strong culture of repair (the highest across all five sectors), and a significant amount of repair and reuse takes place before the gear is discarded, especially for nets, which are very expensive. Over 60% of nets get repaired at least once a year.

Most aquaculture firms and fisheries have a high awareness of plastic pollution and have put different management practices in place. Recognition of the need to reduce the demand for plastic in the first place has also been growing and many aquaculture companies now measure their plastic footprint and have defined an initial circularity roadmap.

It is important to highlight that data accuracy for fisheries is higher than for aquaculture based on deep academic research and field interviews33. Although the data for aquaculture has a higher level of uncertainty and more research needs to be done, good data is available on recycling numbers.

Current commitments are building momentum and more ambitious policies are on the horizon, specifically a new EPR regulation which could make a significant difference if designed and implemented well.

Convenient access to zero-cost disposal is key. Several policies are being discussed in Norway, including Marpol Annex V, the EPR regulation, and the European Directive on Port Reception Facilities that requires waste from ships to be landed and adequately managed in ports. Collection facilities are already being put in place in ports, and a direct fee for handing in waste is being changed to an indirect fee (i.e. the waste handling fee will apply to ships regardless of whether they deliver waste or not), thus removing an incentive for littering. However, it will be a challenge to implement this across all ports and aquaculture farms considering the sheer number of eligible locations in Norway.

According to experts, other key enablers for circularity include design for both longer lifetimes and recycling, research and awareness building on how to better use equipment, making it economically viable to scale up infrastructure and ensure the latest technologies are available (from local sorting, to cleaning and recycling), and making the price of recycled plastic more competitive compared to virgin plastic.

An EPR for Fishing Gear will be introduced by the 31st of December 2024 and could be a game changer if implemented correctly, influencing everything from fishing gear design to end-of-life infrastructure, and delivering the financial resources for the transition33.

Achieving Circularity:

A well-defined and implemented EPR and better information sharing can enable a circular system

Through the combined deployment of upstream and downstream levers, circularity could increase to 81% by 2040 (see Exhibits 25 and 26), and the reliance on virgin plastics could be reduced to 55%, down from 100% in 2020, although having access to enough recycled material could be a barrier. This sector does not have a silver bullet solution. To achieve higher levels of circularity, reuse and recycling should be maximised through better design and scaling up of local sorting, cleaning and recycling infrastructure.

The key upstream lever is reduction, especially through lifetime extension in aquaculture (see Exhibit 26). Better gear design and (re)usage practices can reduce plastic demand by ~36% in 2040 (a cumulative reduction of ~135,000 tonnes between 2025 and 2040).

In our research, opportunities for lifetime extension were identified in both fisheries and aquaculture. However, given that ~90% of the plastic in this sector is in use in aquaculture equipment, where ~13x times more plastics are needed to produce a tonne of fish compared to the fisheries sector, the impact of applying these practices in aquaculture is many times greater.

Lifetime extension is a combination of better design and usage, and in many aquaculture farms initial pilots are already underway to improve both. In terms of design, a good example are the floating collars in aquaculture farms, which represent over 50% of all plastic in stock. Research is ongoing to improve their design by allowing for reuse. Initial results from ScaleAQ show that most floating collars can be repaired and recertified, extending their lifetimes by at least 9 years, although it is believed this can even extend to an additional 20 years. In terms of usage, a good example in aquaculture are feeding pipes. Through changing pressure from compressed air to

EXHIBIT 25

Through the application of circularity levers the Fisheries & Aquaculture sector can reach 81% circularity by 2040

water, and using them underwater, instead of on the water surface, wear and tear reduces significantly and average lifetimes can be expanded from one to approximately four years or longer. In fisheries, a good case can be made for trawl nets, which could be used for longer if they are lifted instead of swept over the seabed, which is also less harmful for the seafloor habitat.

Although Norway is leading the way in terms of design standards, there is still significant room for improvement. For the practices described above, the EPR regulation currently being discussed will be a key enabler. Beyond design, the regulation should consider usage practices and prohibit the discarding of gear that is still of good enough quality through the implementation of recertification processes. Today, too much gear is still being discarded before the end of its lifetime (this happens more often in aquaculture than fisheries, where expensive nets are repaired until this is no longer possible) because it is cheaper to discard elements than reuse them. This particularly tends to happen when a farm is expanding.

Besides the upstream levers, there are three major downstream levers that should be developed.

Firstly, maximising collection, cleaning and pre-sorting facilities in ports or near aquaculture farms could enable up to 90% of waste to flow to formal sorting facilities.

Today, almost 50% of collected waste ends up in residual waste without being checked for recyclable materials, often due to a lack of cleaning and pre-sorting capacity at the port or near the aquaculture farm.

Financing through the EPR scheme will be key to enabling the scale up of these facilities and creating a viable business model. A good example of improving local infrastructure are the local collection and recycling hubs currently being planned by Marine Recycling Cluster34. Some of these initiatives are focused on creating end-to-end loops, others on precycling before selling to recyclers. Another example is Grieg Seafood, which is working on a closed loop recycling scheme for ropes with its rope suppliers and Quantafuel. In Canada, there are also examples of pilot projects coordinated by Ocean Legacy implementing recycling facilities in ports capable of sorting/cleaning and recycling different types of gear.

EXHIBIT 26

The highest impact lever for the Fisheries & Aquaculture sector is Reduction due to lifetime extension opportunities

Secondly, local mechanical recycling in Norway could be expanded to recycle ~36% of total waste volumes domestically by 2040.

The main opportunity is for rigid High Density Polyethylene (HDPE) gear from aquaculture. This high value material is in high demand but the majority is currently exported to larger European players (e.g. Plastix). Supported by financing from EPR regulations, the local industry could become more competitive and expand its capacity further.

The main local recyclers include Noprec / Oceanize, Brontes, and Quantafuel Kristiansund. Today, local capacity is ~6,000-10,000 tonnes and this is expected to double over the next couple of years.

Design for recycling and promoting an increased uptake of recycled content by the industry are other key enablers for growing the local mechanical recycling industry. The Akva Group, in partnership with Plasto and Oceanize, is on track to achieve its mission to develop the first aquaculture farm using 100% recycled content

and has already made good progress35. Similarly, ScaleAQ together with Hallingplast are developing equipment made of recycled material36, 37.

It is estimated that ~45% of input can be recycled content by 2040. Better information sharing will be key to accelerating the uptake of recycled content. For example, a digitised information system that can track quality and control is critical for the market development of recycled plastics.

Thirdly, chemical recycling will remain a key solution for nets and capacity should be expanded. Hard to recycle nets make up >70% of the total plastic waste in fisheries, and >25% in aquaculture11. Even though improvements can be made in terms of design for recycling, the mixed polymer design combined with unrecyclable materials and the condition of the nets at end-of-life will keep this a particularity difficult type of gear to recycle38. However, Aquafil has a patented technology to process nets into Econyl yarn via a depolymerisation process and has created a positive market value. It is likely that chemical recycling of nets will continue to take place outside of Norway considering the investment required.

Zero leakage will remain difficult to achieve.

Along with post-consumer packaging, gear related to the fishing and aquaculture industry is the most significant source of marine litter found on beaches in Norway (18-90% of weight depending on the area)39. In terms of impact, it has even higher negative effects, due to ghost fishing and smothering. It is very difficult to trace either the origin of the gear or the year of loss. Although Norway is a frontrunner in terms of good management practices to avoid leakage into the ocean, and is able to recover the majority of large gear lost, small items that are lost or discarded remain a big challenge. This also makes clean-ups particularly difficult and expensive.

Some experts believe biodegradable materials would be more effective than retrieval programmes, although most experts agree their use will remain very limited and the overall effect on circularity will be negligible. Further research and development into biodegradable materials for fishing gear is needed to understand technical feasibility. Dsolve is a good example of a Norwegian collaborative research programme on a mission to develop new biodegradable polymers for the marine environment40.

EXHIBIT 27

Key recommendations per actor

RECOMMENDATIONS

The Fisheries & Aquaculture sector should prioritise three main actions:

- Introducing an ambitious EPR policy built together with main players to accelerate action and finance the transition.

- Accelerating the implementation of circular strategies by aquaculture farms and fisheries, including reuse and recertification, creation of closed loops, use of recycled content, and continued focus on usage optimisation.

- Using information flows and product/material tracking to guarantee documentation on risk analysis for recycled products.