What could a deep reset of the sustainability movement look like?

Read “Shock Therapy” and tell us what you think.

Nine years ago in April 2016, we founded Systemiq with a sense of urgent possibility. The world had just come together around the Paris Agreement and the Sustainable Development Goals. There was a new global consensus — imperfect, but inspiring — that system change was both necessary and possible. Then came the shocks. Much of the past decade has felt like a struggle to hold the line. We’ve seen populist backlash, geopolitical fragmentation, pandemic disruption, and now a resurgence of conflict and economic insecurity. Climate and nature progress has been real — but painfully uneven, and often vulnerable to shifting political winds. Today, many of the ideas and assumptions that powered the sustainability movement over the last generation feel tired, contested, or simply insufficient.

As we look towards Systemiq’s tenth anniversary, this feels like another inflection point — not just for us, but for the broader project of sustainability. What we need now is not just more ambition or more urgency. We need a reset: of narrative, of strategy, of the role that sustainability plays in driving shared prosperity, resilience and innovation in a world that is changing fast. The essay here is our initial contribution to that conversation. It’s not a manifesto, nor a playbook. It’s a provocation — an attempt to reframe the questions, challenge some of the orthodoxies, and suggest what a more forward-looking, politically aware, and opportunity-driven sustainability agenda might look like. It draws from the incredible insights and honesty shared by contributors to the Blue Whale Inquiry, and from our lived experience working across systems, sectors and geographies.

We don’t expect everyone to agree with all of it. Our hope is to spark debate, collaboration, and renewed clarity — for Systemiq, and for the movement we are proud to be part of. We look forward to your feedback, your challenge, and your engagement in reshaping the sustainability agenda, as we seek to use this reset moment wisely.

Shock Therapy

There are two inescapable truths about system change. First, it’s a 30–50-year process, which goes slow for a long time, until it happens all at once. Second, shocks matter and are often critical to accelerating the underlying pace of change.

The sustainability movement has long hoped for a major shock to the system. Now, three shocks have come along, all at once. We have seen breaches of the 1.5 degrees threshold much sooner than expected, and large-scale physical (and financial) climate impacts are rapidly becoming the new norm. Second, we have seen a dramatic acceleration in climate tech, especially around clean electrification, coupled with the promise of transformative change unlocked by Artificial Intelligence (AI). Third, we have a US administration which sees “climate action” as an ideologically motivated agenda, undermining US competitive advantage in global energy markets, constraining the free market and creating an unfair multilateral straitjacket. More generally, there has been a loss of political momentum and confidence around the net zero agenda.

Together, these shocks present a huge opportunity for the movement to press the reset button, if we can use them wisely. This does not mean giving up on our goals, our values or on the science. These need to be constants. But it does mean that our current strategies are not working well enough (i.e. we are miles off 1.5 degrees; equally on nature/social inclusion challenges) and we need to adapt fast.

Over the past few months, Systemiq has been conducting research into the main factors leading to successful system transformation. In that context, we have also been fortunate to speak to over 50 amazing leaders (with more to come) from civil society, business/finance, the scientific community, politicians, civil servants and thought leaders (see Appendix A). What we have heard is a need for a major reset of our narrative, strategy and stakeholder capital building. Specifically, we heard broad (although not unanimous) support for seven priorities. None of these priorities are new – but equally, none are where they need to be.

A new frame for the sustainability agenda, based on the promise of a better life, and an abundant, thriving and safe home for all.

A practical contribution to near-term political priorities, especially healthy economic growth, cost of living, and security; pulling climate (in particular) out of the culture wars.

Demonstrated tangible improvements in the lived experience of ordinary families in their local communities, ranging from clean air to resilience to jobs.

A strong embrace of digital/AI technologies as a critical accelerator of the transition, provided it is combined with greater access to those technologies, especially for developing nations.

An unflinching recognition that the pace of the transition depends primarily on how fast the new (energy/food/materials) system can outcompete the old system.

A doubling down on the architecture for putting climate & nature (including physical risk) onto the spreadsheet for public and private investors, especially those (institutional owners, SWFs, family-owned businesses, private equity) that can take a longer-term view.

The embrace of multi-polarity in the international system, with increasing norm-shaping power in the hands of players from the so-called Global South.

Each priority area presents very real dilemmas. We want to rally citizens around the promise of an abundant and prosperous future, but we need to be straight about trade-offs, and where the benefits will take time. We want to be on the side of good growth, but without enabling the inequality and overconsumption baked into current economic models. We want to embrace the immense potential in technology, without succumbing to naive techno-optimism. We want to relentlessly push our governments towards ambitious international action, while recognising that most implementation does not happen at this level.

All of this means making choices, and while Blue Whale has identified broad areas of consensus, it has also uncovered points of disagreement. We offer the suggestions which follow in a spirit of urgent collaboration, and we welcome your views, challenges and partnership. We don’t expect everyone to agree with all of it. Our hope is to spark debate, collaboration, and renewed clarity — for Systemiq, and for the movement we are proud to be part of. This is, in essence, an attempt to distil our collective wisdom: can we together find an agenda-reset that allows the sustainability movement to grow through the storm?

1. From scarcity nightmares to dreams of the good life: finding the overarching frame

The sustainability movement has often done a remarkable job on substance — but has struggled to win on story. Net zero, gigatonnes of emissions, parts per million — these may be scientifically precise, but they do not move hearts or change votes. Nor do breathless warnings of ecological catastrophe or appeals to global public goods. These feel distant, abstract, and disconnected from people’s lived experience. Even the language of “system change” — though intellectually vital — can feel alienating. Perhaps the first rule of system change is: don’t talk about system change.

At its best, sustainability is a promise of freedom: freedom from polluted air, from unaffordable energy, from food systems that harm our health and ecosystems, and from plastics and chemicals that trash our environment, while entering and damaging our bodies. It’s the promise of green space, warm homes, safe streets, and resilient local economies. It’s not about restrictions or fear — it’s about the possibility of a better life.

If there’s one thing to learn from successful populists, it’s this: speak to people in words they relate to, and about the things they care about. The most powerful movements are rarely built by command-and-control messaging. But we can still gather around a shared frame — one that speaks to human hopes, not just planetary risk, and does so in terms which can forge some common ground in today’s polarised social media landscape. In doing so, we must never cede the language of freedom and prosperity to those who claim that sustainability means coercion and control.

What should that frame be? Three ideas have been proposed. Abundance shifts the narrative from scarcity and sacrifice to generosity and opportunity. Resilience speaks to our desire for safety, especially in a more volatile world. Perhaps the most powerful, and unifying, is the idea of home.

Home is both personal and shared. It bridges past, present and future. It implies safety, belonging, identity, and possibility. It touches security (physical and financial), opportunity (local jobs, decent services), and pride (in community, landscape, and legacy). Everyone deserves one – and one free from pollution and discarded waste. And the Earth is the only one we all share. Crucially, the idea of home can hold both resilience and abundance within it — the protective and the aspirational — without requiring anyone to choose between the two. This frame is not just another metaphor. It’s the story that can hold the rest of our agenda together — linking freedom, wellbeing and progress in ways that are deeply felt across cultures and contexts.

Of course, telling a better story isn’t enough. The current system isn’t stuck by accident — it is held in place by powerful interests. From industry incumbents to rentier capital to status-quo political economies, there are actors who benefit from delay, distraction and division (and who benefit from the amplifying algorithmic distortions of social media). If the sustainability movement wants to reframe its agenda, it must also confront these realities. We don’t win by pretending they will disappear. We win by building alliances that outcompete them in the real economy, by shifting legitimacy, and by making inaction politically and economically untenable. A new story is not a substitute for power — but it can be one of its most effective tools.

This is also why the fusion of climate and nature matters so deeply. Today, these operate in parallel. Climate is often abstract and global, focused on carbon and energy systems. Nature is rooted in place, life, and connection — tied to forests, water, food, health, and culture. Climate speaks to the head; nature stirs the heart. Climate can be politically polarising; nature, when well-framed, is often bipartisan. Yet they are deeply intertwined — nowhere more so than in the food system, where emissions, ecosystems, livelihoods and public health all collide.

Bringing climate and nature together doesn’t just make strategic sense. It makes the story easier to tell. People don’t dream in carbon budgets. They dream of flourishing neighbourhoods, of cities lined by trees not traffic, of affordable food grown in healthy soils, of good jobs that give something back, of clean air and water, of places that feel safe and vibrant and alive. These are the building blocks of a good life — and they are all part of the sustainability agenda when it is seen whole.

It also opens up a much wider cast of actors. From food and water companies to insurers and tourism operators, many sectors now have a financial stake in nature-based solutions. These solutions help buffer against floods, heatwaves and fires. They improve wellbeing in urban areas. They create new industries and new kinds of work. Countries like Costa Rica, with its reforestation and eco-tourism model, or Brazil, through its Ecological Transition Plan (ETP), are already showing how national economic strategies can be rooted in natural capital and deliver real returns.

That’s why it is symbolically powerful — and strategically useful — that COP30 will take place in Belém, on the edge of the Amazon. It grounds the transition in place, in people, and in life itself. It reminds us that climate isn’t just about carbon. It’s about home. And if we can tell that story — of shared home, renewed abundance, real resilience — then we can offer something far stronger than fear or sacrifice. We can offer a future worth choosing.

2. Aligning with today’s political priorities, and winning on better growth and security

We heard repeatedly from Blue Whale interviewees about the need to rethink how sustainability aligns with today’s political priorities — not just to defuse the culture wars, but to win them. The most corrosive attack on this agenda remains the “economic hardship narrative”: that while self-serving “green elites” push their vision of the future, ordinary people face job losses, unaffordable bills, and rising economic insecurity. This framing powers many of the more ideological critiques — that sustainability is out-of-touch, anti-growth, or anti-worker. And it hinges on one powerful accusation: that we care more about the future levels of a gas that no one can see, than about the economic pressures people face right now.

The best answer to that charge isn’t a better story — it’s better outcomes. Sustainability must prove itself in people’s lived experience. That means focusing squarely on the core concerns of most voters and citizens: economic security, good jobs, affordable energy and food, and the hope that their children will live better lives. These aren’t tangential benefits of climate action. They are the political case for it.

Take energy costs. In many parts of the world, the sharp increase in energy bills since the Ukraine invasion has been driven not by renewables, but largely by higher, more volatile gas prices — which continue to shape electricity and heating costs due to their price-setting role in markets and as an industrial feedstock. There is growing evidence that shifting to a cleaner, more electrified energy system could drive down not only emissions but unit costs and system-wide demand. Electrification brings with it an inherent energy efficiency gain — often 2x or more compared to fossil systems. Modelling for the UK suggests that if household and industrial energy costs could be reduced by 20%, the result could be an uplift in GDP growth of 0.3–0.5% per year. That would be an enormous prize — economically, socially, and politically. And it depends fundamentally on accelerating the transition to a clean power grid, coupled with wider electrification of the economy.

Food costs are equally important — and politically potent. In countries such as Kenya and Nigeria, food accounts for nearly 60% of household expenditure. In more than 30 countries, food still accounts for over 30% of household spending for most of the population. A sustainability agenda that can stabilise agricultural productivity, reduce dependence on volatile global markets, and reward farmers for regenerative practices is an agenda that delivers for voters, not just ecosystems. Likewise, the promise of good, well-paid jobs in transition sectors — especially for younger workers — is central to how this agenda can build public trust. The point isn’t to claim there are no transition costs, or that every green job is high-quality. It’s to make sure the payoff is real, local, and fair.

Defence, of course, has returned to the centre of national agendas — and will likely stay there. While this may constrain fiscal space, it doesn’t have to crowd out sustainability. Energy security, supply chain resilience, and electrified defence logistics are all examples of intersection points where climate-smart strategies can support broader statecraft. Militaries are still among the world’s largest fossil fuel consumers, and modern security systems will depend heavily on AI and electricity-intensive technologies. Let’s not romanticise the return of defence budgets. At best, they are risk management. At worst, they are a zero-sum arms race. And when governments slash overseas aid spending to bolster defence budgets and “hard power”, it is an act of self-harm – draining finance away from development programmes that are the foundation of stability and security. Sustainability should not position itself in opposition to defence — but nor should it sell itself short to win favour among security hawks. These agendas can coexist, but they are not equivalent.

We need look no further than China to see what a long-term, strategic approach to clean growth can deliver. Yes, the contradictions are real — last year China built nearly 100GW of new coal-fired power. At the same time, it has become the global leader in almost every major clean economy value chain: solar, wind, EVs, batteries, electrolysers, critical minerals, transformers. These “clean growth” sectors now account for over 10% of China’s GDP. The strategy isn’t about climate virtue. It’s about growth, competitiveness and long-term security — backed by finance, coordination and delivery capacity. A decade ago, China identified these industries as central to the next wave of global markets. It aligned industrial policy, innovation and investment, and it’s reaping the benefits.

Other emerging economies are moving with similar intent. Brazil is beginning to stake out a leadership role in the bioeconomy — using its extraordinary biodiversity and natural capital base to develop new industries in low-carbon food systems, pharmaceuticals, and regenerative agriculture. This isn’t just about protection. It’s about value creation. Indonesia, meanwhile, has pursued a deliberate national strategy to build out its role in the global battery supply chain, leveraging its vast nickel reserves. There are hard questions here — much of the domestic processing is powered by captive coal — but the strategic logic is clear: this is an industrial play, designed to move the country up the value chain and secure a stake in the clean tech economy.

What unites these examples is not ideology, but intent: they treat climate-linked sectors not as obligations, but as opportunities to build national competitiveness. That mindset — rooted in national ambition, coordinated strategy and visible outcomes — is what the sustainability movement must now champion. Because if we can deliver lower bills, better jobs, cleaner air and stronger economies, we won’t just win the argument. We’ll win the future.

3. Local economic development and the lived experience of ordinary citizens

One of the most powerful ways to bring the sustainability agenda home is to focus on place-based solutions. In the rich tapestry of human motivation, pride in place, community, and belonging have always mattered. And the origins of environmentalism lie in grassroots action. Yet, despite recognition of the importance of local efforts, climate action — particularly emissions reduction — remains overwhelmingly top-down. Investment flows, governance systems, and economic incentives rarely empower local institutions. Everyone likes the idea of decentralisation in principle, but few international or national actors are willing to cede the capital or authority required to make it real. Worse still, localism and climate ambition are sometimes pitted against each other — especially when it comes to permitting critical clean energy infrastructure.

But the tide may be beginning to turn. As the physical impacts of climate change intensify, resilience is emerging not as a specialist sub-topic, but as the frontline of climate and development strategy. And resilience can only be built locally — through institutions, infrastructure, and decision-making that respond to the realities of place.

Barbados offers a compelling example. Highly exposed to hurricanes and tropical cyclones — events that can cost up to 200% of GDP in a single year — the country is responding with a resilience and investment plan that integrates energy, tourism, construction, and digital infrastructure. This isn’t just about retrofitting existing systems with an extra 1–2% of climate-proofing capital. It’s a wholesale rethinking of national competitiveness and economic development — rooted in local ownership, long-term strategy, and financial innovation. The plan aligns domestic and international finance in a way that shifts from reactive disaster recovery to proactive resilience-building, with a deep understanding of the costs of delay.

Cape Town is another emerging leader — this time in the growing global effort to combat urban heat. With rural-to-urban migration accelerating across Africa and many other parts of the world, the rise of urban heat island effects poses serious risks to health, productivity, and infrastructure. Cape Town is pioneering new approaches that combine urban design, greening, and digital tools to manage extreme heat. It is also a magnet for emerging philanthropic and concessional capital focused on heat resilience — a trend that could soon become one of the defining investment shifts in climate adaptation.

Meanwhile, in the US and Europe, flooding is becoming a disruptive force across housing, finance and infrastructure systems. In the US alone, over 4.7 million homes are covered by the National Flood Insurance Program (NFIP), a federal mechanism designed to fill the gap where private markets have failed. With the recent announcement that FEMA — the agency responsible for NFIP — could be eliminated, the future of flood insurance has been thrown into doubt. While the politics are still unfolding, the implications are systemic: without NFIP, millions of mortgages would be uninsurable, risking sharp increases in interest rates and an immediate freeze on tens of thousands of property transactions. More fundamentally, flood insurance is not just a financial backstop — it is a tool that helps shape land use, building codes, and local infrastructure decisions. Take it away, and the market loses the data and incentives it needs to adapt. Europe faces similar challenges, with cities like Valencia and Ljubljana grappling with more frequent urban flooding and the legacy problem of housing built on flood plains. Solutions must combine stricter zoning laws, targeted building codes, and nature-based approaches — including the strategic use of upstream wetlands to absorb and redirect floodwaters.

The point in all these cases is the same: resilience isn’t a niche or a cost centre. It is core to how economies grow, how people stay safe, and how the public sector earns trust. And the outdated assumption that mitigation is a private sector concern, while adaptation is a public sector burden, no longer holds. In reality, both require public-private collaboration, financial innovation, and new investment models that unlock local capability rather than deepen dependency.

What we’re seeing now is the emergence of a new model of local development — one that combines collective action with advanced technology (better materials, early warning systems, stress-resilient crops, distributed energy networks), smarter logistics, greater circularity (which also creates jobs), and much more use of nature-based solutions. This is integrated planning for a better, more resilient economic future. And done well, it could give climate action a better name among those who doubt it — not as a global burden, but as a source of pride, prosperity and security, close to home.

4. Embracing the digital & AI revolution

It’s hard to overstate the potential significance of AI to the sustainability transition. After years of incremental progress in systems reform — across energy, materials, land, transport, and governance — AI now offers the chance not just to optimise existing processes, but to recode how change happens. From integrating renewables into power grids to simulating nuclear fusion reactions, from predicting extreme weather events to accelerating advances in alternative proteins and material science, AI is emerging as the second major lever for net zero — after renewables themselves.

Our analysis suggests that, relative to current projections, AI could help cut global emissions by an additional 15–20% by the mid-2030s. But the potential goes far beyond mitigation. In principle, AI could enable the greatest ever transfer of skills, data, and capability to developing countries. And in countries around the world, AI-powered tools could help modernise institutions and build public sector capability — doing for governance what digitisation did for banking, and what mobile networks did for connectivity.

Some countries are already moving. The UAE has embedded AI in smart-city initiatives focused on energy management, building efficiency and environmental monitoring — recognising that technological capability is fast becoming a strategic asset. But perhaps the most important example is India, which has built what may be the most effective public digital infrastructure in the world. The “India Stack” — combining biometric ID, digital payments, e-government services and e-commerce layers — has enabled a new wave of AI innovation across health, education, and agriculture. It’s a model of what inclusive digital infrastructure looks like at scale. When Gates and the UK’s FCDO launched an AI challenge fund, they received thousands of submissions from Indian startups and institutions. But the real secret was the public scaffolding already in place — infrastructure designed not just to scale transactions, but to democratise capability.

This is the kind of foundation the sustainability movement can now embrace. Rather than watching the AI revolution unfold — or waiting passively in line for the latest breakthrough — we need to put AI at the heart of our mission. And not just any AI. The real opportunity lies in AI that is open-source and properly regulated — so that its risks are contained, and its benefits widely shared. The market won’t deliver this on its own. Guardrails for safety, rules for transparency, and incentives for openness must be deliberately built into the system.

This also means engaging more deeply with the tech industry — even when it feels uncomfortable. Silicon Valley’s record on climate misinformation, excess consumerism and democratic erosion has made many in the climate world wary. Meanwhile, the computing power needed to train large models is growing fast. Data centres currently consume around 2% of global electricity, and could more than double their share in just the next few years — potentially reaching 12% of US electricity demand by 2028. Ireland is already over 20%. In the short term, this puts further pressure on fossil fuel use, and risks competing with scarce clean energy. Even if the demand surge is temporary, and later offset by emissions reductions enabled by AI, it raises hard questions for a movement already disillusioned with corporate promises.

Yet this same energy footprint could become a lever. The tech giants — with deep pockets, long time horizons, and insatiable electricity demand — could be the drivers of clean energy expansion and smarter grid optimisation. If channelled well, their ambitions could supercharge renewables in ways that governments alone cannot. Meanwhile, the emergence of powerful open-source models likeDeepSeek may prove to be AI’s “Sputnik moment”: a crack in US dominance, and the start of a global race for better, faster, cheaper, and less energy-intensive alternatives.

This opens the door to more radical visions of transparency and shared intelligence. Imagine a global, AI-powered, open-access platform for environmental data. In agriculture alone, it could transform everything. Farmers could access real-time insights not just on yields and profits, but also on soil health, carbon sequestration, water stress and biodiversity recovery. Shared openly, this data could fuel peer-to-peer learning and accelerate regenerative agriculture at a scale never seen before. It would reshape incentives too — enabling climate-smart subsidies, carbon and biodiversity markets, and new forms of rural finance. The first Green Revolution transformed food production with better seeds and fertilisers. The next could be driven by intelligence and connectivity —

5. Shrinking the old system by building the new

Over the past decade, a huge amount of the climate movement’s energy has, understandably, been focused on trying to shut down the fossil fuel economy. Activists frequently cite that fewer than 30 companies, most of them in oil and gas, are responsible for over half of historic emissions. Shutting down these companies and cutting off their political influence are aims at the heart of the divestment movement, as well as campaigns to block pipelines, oil fields and coal mines.

This strategy is morally compelling, galvanising for the climate movement, and it has delivered some notable local victories. But overall, it has had little material effect on the scale, power, or emissions of the fossil fuel industry. More oil, gas and coal are being produced and consumed today than at the time since the Paris Agreement. There are many reasons for this — not least growing global energy demand and governments’ short-term energy security imperatives. The war in Ukraine reminded leaders just how dependent they still are on fossil fuels — and how quickly that dependency can become geopolitical vulnerability.

The alternative and more reliable way to shrink the legacy system is to super-charge the new one. When the alternative becomes cheaper, faster, more appealing and versatile — as is now the case with clean electrification — change happens rapidly. And when investors can anticipate that tipping point and expect decent risk-adjusted returns, they pile in ahead of time and make the transformation self-fulfilling. That’s the key dynamic. It often requires smart public policy — including fiscal incentives, regulatory reform, and infrastructure investment — to accelerate the crossover. The clean electricity system is, in many respects, just like AI: today’s version of it is the worst that we will ever experience (while for fossil energy, it’s never going to get much better). The sustainability movement should therefore focus its limited resources on vigorously scaling the new system: removing the barriers that hold it back, whether in permitting, market design, access to critical minerals or prohibitive finance costs in the Global South (not least by correcting risk misperceptions). And this isn’t just about getting us all off hydrocarbons: if we are to accelerate the shift away from harmful plastics and forever chemicals, or from extractive, high-emissions agriculture as well as ultra-processed food, we will need to dramatically improve the performance of the alternatives — and fast.

As we scale up, it will become easier to scale down. What are the actions that can accelerate the decommissioning of the legacy fossil energy system? We believe there are four.

First, governments and regulators should be laser-focused on eliminating methane leakages, venting and flaring. Methane is responsible for roughly 20–30% of observed global warming since the Industrial Revolution, and its control represents one of the cheapest, fastest ways to slow climate change. These emissions should be treated like oil spills: reckless, costly, and unacceptable — with penalties and enforcement to match.

Second, oil and gas companies should be encouraged to shrink their capital base over time — through maximum dividends and share buybacks — rather than investing their cash flow in ill-fitting transition strategies. This is, in effect, a form of market-based divestment. Investors can then decide whether to reallocate that capital into clean energy or use it for other legitimate needs, including pension payments. For many asset owners, particularly pension funds, fossil dividends are an essential cash flow — but there is no strategic case for allowing these firms to reinvent themselves as clean energy leaders when neither their mandate, cost of capital nor culture supports that shift.

Third, governments must revisit the vast web of fossil fuel subsidies and tax exemptions, many of which are indefensible. Some poverty-oriented subsidies may be justifiable in the short term. But the rest — estimated at over USD 500 billion per year — need to go. The failure to tax aviation fuel, for instance, is a glaring example of incoherent policy in the face of climate reality.

Fourth, we need a serious timetable for phasing out the legacy system — including hard requirements for carbon dioxide removal, repurposing of infrastructure, and self-financing of all Scope 1 and 2 emissions reductions/removals (including methane) as a basic licence to operate. The industry’s future role should be explicitly tied to its contribution to cleanup, not expansion.

In the end, the speed with which we can phase down fossil fuels — coal, oil, and gas — will depend far more on our ability to electrify the uses of energy than on our capacity to shut down supply. Raising electrification from around 20% today to 70–80% by mid-century is the single most powerful enabler of the transition. It shrinks demand for fossil fuels at the source, cuts exposure to price volatility, and can raise end-use efficiency by up to 40% — making middle-class life both cleaner and more affordable. That’s why countries across the ASEAN region are now collaborating on a clean electricity super-grid: not for climate reasons alone, but for competitiveness, resilience and shared prosperity.

6. Putting climate & nature on the spreadsheet, especially for medium-to-long term investors

Around the time of COP26, parts of the climate movement, several forward-leaning governments, and an array of heavyweight financial institutions embraced the thesis that the finance sector could lead the charge on climate. After all, every investment is a climate investment (partially true). And what’s not to like about USD 130 trillion of institutional capital (even if mostly pledged AUM rather than investable firepower) just waiting to be deployed to accelerate the shift to a net zero economy? Many headlines followed, which served the interests of politicians (who could conveniently outsource hard policy decisions to the financial sector) and financial institution leaders (who could be the heroes).

However, the high hopes have not materialised; the financial system continues to be relatively short-term in how it prices and allocates capital. As a result, it is unreasonable to expect that capital markets — or financial institutions more generally — will naturally “price in” climate (or nature/social) risk in a way that drives capital allocation at the scale and speed required. The current anti-ESG wave does not help, but it is not the root cause of the challenge. The structural time horizons of financial markets — shaped by quarterly reporting cycles, benchmark-driven performance, and regulatory frameworks that undervalue long-term risk — are the deeper issue.

What does this mean we need to do? Lesson number one from the past decade is that no amount of financial engineering can substitute for good public policy. Capital markets still need the political system to set direction and shape investor expectations. In a similar vein, “blended finance” can make a difference in overcoming exaggerated risk perceptions — particularly in emerging markets — but again it cannot act as a substitute for effective institutions, reliable regulation, and predictable policy. This is especially true for the long-term capital needed to flow into energy, infrastructure and nature-positive investment.

Second, our best allies in the financial system are those players that are naturally medium-to-long term: sovereign wealth funds, asset owners, family offices, and especially private equity. Indeed, it is the private equity industry — across venture, growth, buyout, infrastructure and real estate — that has emerged as the most active player in driving capital into key transition assets. This is not accidental. These investors operate with 7–15-year time horizons and are protected from the tyranny of quarterly earnings reports that dominate public markets. We may not like the “2 & 20” reward model of the PE industry, but it attracts some of the most imaginative financial talent and most risk-tolerant capital into the transition. And as institutional asset owners — pension funds and insurers — continue to increase their allocations to private equity (rising from 5% in 2010 to 15% in 2024, with more to come), this represents one of the best chances to steer more capital into climate- and nature-positive outcomes. But this too depends on enough of the PE industry holding the view that the shift to a sustainable economy is the growth story of the 21st century — and that technology and policy will broadly move in the right direction.

Third, we need to double down on the tools available to financial regulators, institutions, and companies to measure climate- and nature-related risks. We’ve seen huge progress in science-based targets and pathways, value chain emissions tracking, and corporate performance monitoring. Over the next few years, a similar tech-enabled revolution is likely to transform nature and social risk disclosure. There is no going back on these tools. But they need refinement, simplification, and better integration into financial reporting systems. Companies must find it easier to start — with clearer baselining, target-setting and disclosure pathways — and must believe they are participating in a race to the top, rather than being trapped in an acronym-heavy compliance regime. While the SBTi already works with some 10,000 companies, there are over 200,000 large firms globally — including 60,000 listed — so there is still plenty of ground to cover. Crucially, these tools can only shift capital flows if they are embedded in regulatory frameworks and capital adequacy rules that reward better climate and nature performance — not just reporting.

Finally, over the past decade, the climate finance community has overwhelmingly prioritised the net-zero agenda. In contrast, the physical risk and resilience agenda — essential for safeguarding people, assets and systems from accelerating climate impacts — has received far less investment, innovation, and institutional focus. As a result, financial institutions — banks, asset managers, and especially insurers — are sitting on a time bomb of potential liabilities. In California and Florida, homeowners are seeing insurance premiums skyrocket, or being redlined entirely. 10% of the US mortgage-backed securities market is already at risk. The US may never have implemented a federal carbon price, but the real economy is starting to do the job — through insurance markets. As the Financial Stability Board (not known for hyperbole) recently warned: “There could be an abrupt broad-based repricing of climate physical risk, as the expectation of larger future losses are incorporated into current prices and impact sectors and jurisdictions not currently directly affected by disasters.” This is the new front line of climate action — and fiduciary stewards must now explain how they are discharging their duty in the face of it. The shine of ESG might be fading, but the age of accountability for physical climate risk is just beginning.

7. Rewiring multilateralism for a fragmented world

The post-war multilateral system is no longer delivering against the urgency of the planetary crisis. It was designed to enhance stability and consistent rules between nations, not to orchestrate collective action across sectors, actors, and borders on complex global commons, such as climate stability, biodiversity protection, ocean health and pandemic resilience. The task now is not to discard multilateralism, but to rewire it: to make it faster, fairer, and more fit-for-purpose in a world where power is shifting and new alliances are emerging in response to intensifying geopolitical rivalries, and new trade wars, fuelled largely by the administration in the US.

Nowhere is this more urgent than in the agenda for climate and nature. While we should not romanticise multilateral cooperation, nor should we dismiss it. The Montreal Protocol remains one of the most successful environmental treaties in history, fixing the hole in the ozone layer (and dramatically cutting greenhouse gas emissions). The Paris Agreement, for all its flaws, has created a common language, a shared ambition, and a framework for ratcheting progress. In the last few years, we have seen landmark international agreements on reversing biodiversity loss and protecting the world’s oceans, while plastic waste has, in record time, gone from being a relatively niche political issue to the subject of serious treaty negotiations (even if those negotiations are yet to yield the needed results). These are extraordinary feats of coordination. But they are exceptions, not the rule. They set vital frameworks but are not engines of implementation. They are simply not enough.

To deliver for climate and nature in this new age, we need a new kind of internationalism, one based less on summit communiqués and more (building on lessons from global public health) on targeted, performance-oriented partnerships. These coalitions aren’t based on ideology or traditional alliances, but on solving problems and mobilising resources.

Some of the most promising examples are being shaped by the Global South. India’s International Solar Alliance, co-launched with France, is building shared infrastructure and technology transfer for solar deployment across tropical countries. Its Coalition for Disaster Resilient Infrastructure is creating new design standards and financial tools to reduce vulnerability before disasters strike. The African Union’s Great Green Wall is rehabilitating degraded land across 11 countries — an ecological, economic and political act of continental significance. Even China’s Belt and Road Initiative is evolving from its original infrastructure mandate into a vehicle for sustainable investment, with new guidelines and pilot projects in energy and transport. These efforts matter not just because of what they do, but because of who is shaping them — a signal that the South is no longer just the subject of multilateralism, but a primary author.

This shift should also shape the future of the COPs. The climate, biodiversity and desertification COPs have become sprawling convenings, often more about process than progress. And yet, they serve a critical normative function — setting direction, surfacing pressure points, and anchoring accountability. Rather than diminish them, we need to evolve them. A 21st-century COP should be 20% about rule-setting and global stocktaking — and 80% about orchestrating delivery. That means giving formal standing to non-state actors: cities, Indigenous groups, development banks, and companies with transition plans. It means transforming NDC submissions into investment-grade transition platforms, capable of crowding in capital and technology. The Global Stocktake should become a data-driven annual dashboard, owned by a neutral platform — potentially an upgraded IPCC with independent, depoliticised analytics. And philanthropies should move from parallel grant-making to platform-building: supporting risk instruments, catalytic equity, and transition planning tools that governments can plug into. The COP should be not just where pressure is applied, but where action partnerships are born.

Nowhere is this clearer than in climate finance. The current international system is not only underpowered, but structurally outdated. It reinforces dependence through complexity and conditionality. Despite years of pledges, the USD 100 billion finance target has barely been met — and often through creative accounting rather than real flows. The fragmented architecture of public climate funds needs a root-and-branch overhaul. Meanwhile, many developing countries face rising debt burdens, declining creditworthiness, and growing exposure to climate shocks — exactly when they most need investment (estimated at around USD 1.4 trillion per year, excluding China). Up to USD 1 trillion of that investment will have to come from domestic and private sources. Concessional international finance, with multilateral development banks in the lead, is key to closing the remaining financing gap and also to crowd in private capital for clean energy, sustainable infrastructure and climate-resilient agriculture systems.

The next chapter should be defined by mutual advantage. When developing countries succeed in building clean energy systems, resilient landscapes and healthy populations, they create shared value — for supply chains, financial stability, and emissions reductions worldwide. A redesigned financial architecture should aim to unlock sovereign strength: through debt-for-climate swaps, credit enhancements, and co-investment platforms that blend concessional and commercial capital. Institutions like the World Bank, regional development banks and other development finance institutions must shift from project finance to systemic transition platforms. And new green liquidity mechanisms — from SDR allocations to carbon-linked securities — could anchor a more just international financial order.

Part of this reordering should also involve building credible, global-scale tools for transition. High-integrity carbon markets are one such tool — not because they are perfect, but because they offer a bridge between what the world wants (deep decarbonisation) and what developing countries need (a way to monetise their natural assets and fund alternatives to extraction). If done right, carbon credits should function less like voluntary offsets and more like a currency: tied to real mitigation outcomes, governed by shared standards, and embedded in financial systems that lower the cost of capital.

Multilateralism will not be rescued by rhetoric. Its reinvention depends on practical legitimacy — on institutions and partnerships that solve real problems, in real time, with real accountability. That legitimacy can no longer come from the North alone. The Global South is already demonstrating leadership — not only in moral claims, but in practical designs. The task now is to empower that leadership, simplify the systems, and focus relentlessly on delivery.

There is more to say on all these themes. The aim here is not to “solve” the crisis now engulfing sustainability – but to outline a set of leaps and turns that would allow our agenda to navigate this disorienting, gravity-defying moment. And to set ourselves up not just for the five-year project (however critical these next five years are), but for the 30-year project of deep systemic change. They are, in essence, simple and intuitive, even if all are proving staggeringly hard. A more compelling vision. Greater political and public resonance. Victories on the ground. Harnessing the full benefits of the most important technologies. A better-choreographed expansion of the new system to crowd out the old. Mobilising private capital, with more illiquid players in the lead. Expanding international cooperation beyond state actors. Even if we need to go levels deeper on each, debating the substance and practicalities as we go, can we agree that these are the changes we need?

We are probably – hopefully – in the hardest part of transitioning our economies as we get into the hard yards of implementation. It often feels that we are collectively doing more than ever, while our problems still run away from us: that we are heading to the edge of the precipice, while the new system stutters and the old one refuses to give way. But this is how it was always going to go. As Mark Twain put it, “All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.” The moment is messy, frustrating and unpredictable – but its radicalism creates opportunities, too.

In this note we have barely spoken about the critical dimensions of leadership (both inner and external) and collective action, but they are the threads which run through every reflection and suggestion, and we will come back to them again and again in this process. Holding up the mirror, being brutally honest, and asking together what we should and can do differently, have come up in interview after interview. So, too, has the need to distinguish between core values, which do not change; messages, which may evolve; and tactics, which must adapt.

Our focus now, within Blue Whale, is to keep digging, pulling in different voices and creating spaces in which we can come together to challenge and develop these ideas – aiming, always, to make them practical and actionable. We are also building up the library of compelling case examples, which demonstrate that systemic change is possible, and help us understand what it really takes. It is all rich soil to explore what Otto Scharmer calls the emerging future. Some of that future is already here, hiding in plain sight, if we know where to look. The rest we will have to invent and shape together.

Appendix A: Blue Whale Interviewees – as of April 2025

Below is a list of interviewees spoken to so far, not including interviews held with all Systemiq Partners. The interviews are ongoing, and we are expanding the representation of different perspectives and world views and getting to more leaders from different regions and industries. We are grateful to all the interviewees for sharing their experiences openly and generously, and we will continue to share back our insights and learnings.

• Adair Turner, Chair, Energy Transition Commission

• Agnes Kalibata, President, Alliance for a Green Revolution in Africa (AGRA)

• Ajay Mathur, Director General, International Solar Alliance

• Andrew Steer, President and CEO, Bezos Earth Fund

• Artur Carulla, Chair of Agrolimen

• Bernard Looney, Former CEO, BP

• Brune Poirson, Former Deputy of National Assembly of France

• Chad Holliday, Former Chairman, Bank of America, Royal Dutch Shell

• Charles Leadbeater, Senior Associate, System Innovation Initiative

• David Blood, Founding and Senior Partner, Generation Investment

•Emmanuel Lagarrigue, Partner & Co-Head of Global Climate, KKR

• Farhana Yamin, Lawyer, Author and Climate Justice Funder and Activist

• Giulio Boccaletti, Scientific Director, Euro-Mediterranean Center on Climate Change

• Henry Dimbleby, Co-Founder, LEON

• James Arbib, Co-Founder, RethinkX

• Jamie Drummond, Co-Founder, ONE

• Jeff Seabright, Systemiq Senior Advisor, Former CSO Unilever, co-founder of IMAGINE

• Johan Rockström, Director, Potsdam Institute for Climate Impact Research (PIK)

• Lord John Browne, Chairman, BeyondNetZero, and Managing Director, General Atlantic

• Jon Creyts, CEO, Rocky Mountain Institute

• Jules Kortenhorst, CEO, Bridge Carbon

• Justin Adams, Co-Founder and Managing Director, Ostara

• Kate Brandt, Chief Sustainability Officer, Google

• Katherine Milligan, University Lecturer, Facilitator, and Advisor, Geneva Graduate Institute

• Kathleen McLaughlin, Executive Vice President and Chief Sustainability Officer, Walmart

• Kingsmill Bond, Senior Principal/Energy Strategist, Rocky Mountain Institute

• Mari Pangestu, Special Advisor, International Trade and Multilateral Cooperation (Indonesia)

• Mauricio Porras, Co-Founder & Chief Mobilization Officer, HERO

• Michael Jacobs, Economist and Political Theorist, Sheffield University

• Mikkel Bülow-Lehnsby, Co-Founder, NREP

• Nathaniel Keohane, President, C2ES

• Nicholas Stern, Chariman, Grantham Research Institute

• Otto Scharmer, Senior Lecturer, MIT Sloan School of Management and Co-founder, Presencing Institute,

• Paul Polman, Business leader, investor, philanthropist

• Paul van Zyl, Co-Founder and CEO, The Conduit

• Paula Kovarsky, Vice President/Chief Strategy Officer, Raízen

• Per Pharo, Director of the Department for Climate, Nature, and the Private Sector, Norad

• Peter Bakker, President, The World Business Council for Sustainable Development (WBCSD)

• Rebecca Henderson, Economist, Harvard University

• Rhian-Mari Thomas, Chief Executive, Green Finance Institute

• Rohitesh Dhawan, President and Chief Executive Officer, International Council on Mining and Metals

• Sharan Burrow, Vice Chair, European Climate Fund Supervisory Board

• Shenggen Fan, Chair Professor and Dean, China Agricultural University

• Sian Ferguson, Chair, Friends of the Earth Charitable Trust

• Sophie Lambin, Founder and CEO, Kite Insights

• Svein Tore Holsether, CEO, Yara International

• Todd Stern, Former United States Special Envoy for Climate Change

• Vera Songwe, Founder and Chair, Liquidity and Sustainability Facility

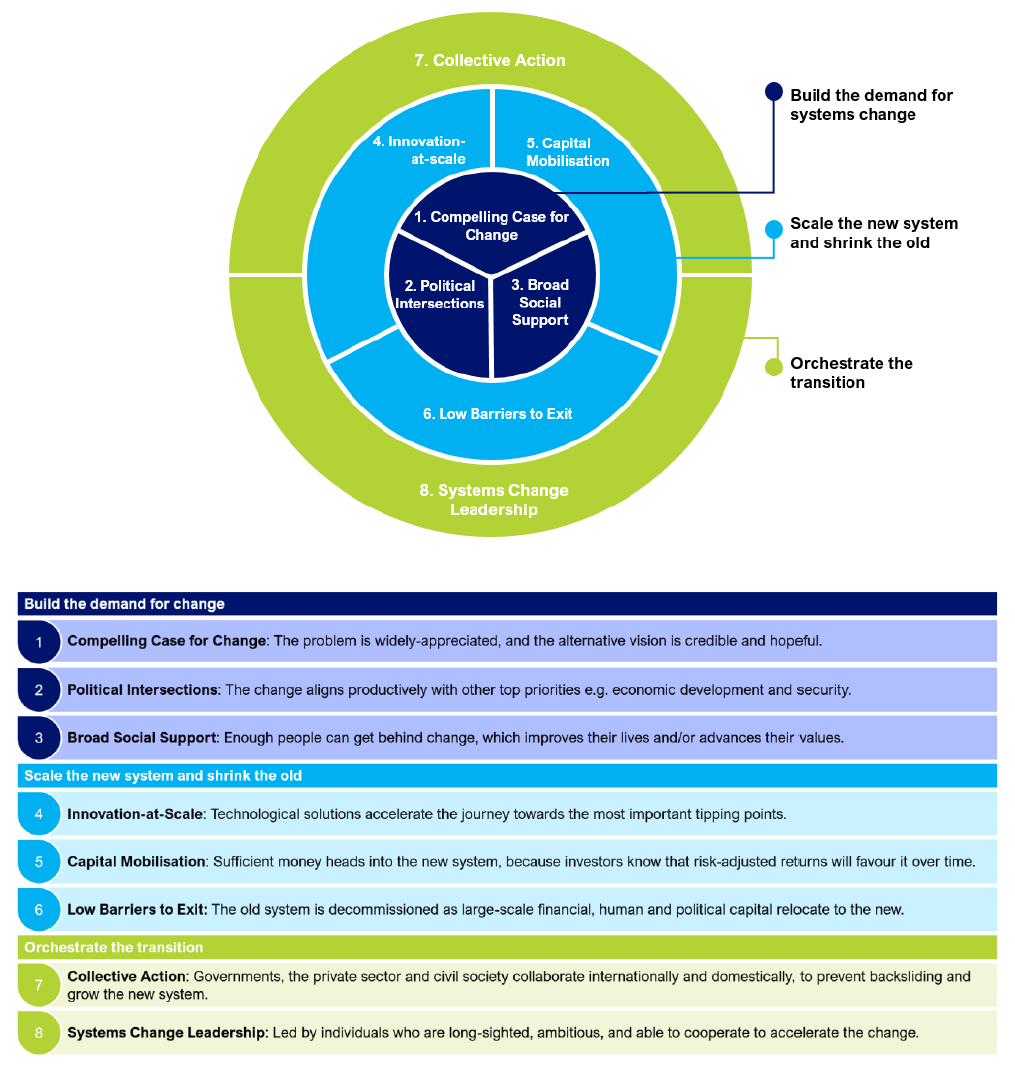

Appendix B: Eight Conditions for System Change

As part of the Blue Whale Inquiry, we are developing a framework outlining the essential conditions for the effective transformation of economic systems (see below). We will be sharing more on this in the coming months.

Acknowledgments

Special thanks to the Blue Whale Inquiry team for your relentless contribution to this effort. Your insight, dedication, and collaboration are instrumental in shaping this work.

In particular, we are grateful to Mattia Romani, Zena Creed, Scarlett Benson, Lizzie Petykowski, Diane Vu, James Miller, Mitch Groves, Johanna Schlueter, Agra Suryadwipa, Robert Taylor, Danielle Gent, Nikki van Dam, Christiana Dujardin and Ben Onyemem-Benedict.

We would also like to thank our brilliant MBA students from Saïd Business School, University of Oxford, whose energy and fresh perspective enriches our work: Carlos Torres, Capucine Lemeur, Thomas O’Brien, Jayant Vig, and Mashaal Khan.