Plastics have been a key enabler of more affordable, durable, and fuel-efficient vehicles due to their low density. However, their rapidly increasing use in the sector has resulted in a large accumulation of in-use plastic stock, and ultimately a decline in the recyclability of vehicles.

While Norway is considered a frontrunner in terms of vehicle collection at Authorised Treatment Facilities, the current system is still highly linear, with 99% of plastics being disposed of either via landfill or, more commonly, incineration. A key barrier to circularity is the lack of regulation focusing on the management of plastics, as the recycling targets of the current End-of-Life Vehicle (ELV) Directive can be almost entirely met without any plastics recycling.

The automotive plastic system is complex and will require the introduction and adoption of new business models to reduce demand (e.g. through shared mobility solutions), the adoption of design for recycling principles to reduce the number of types of polymers, and regulation to enable a well-functioning recycling infrastructure.

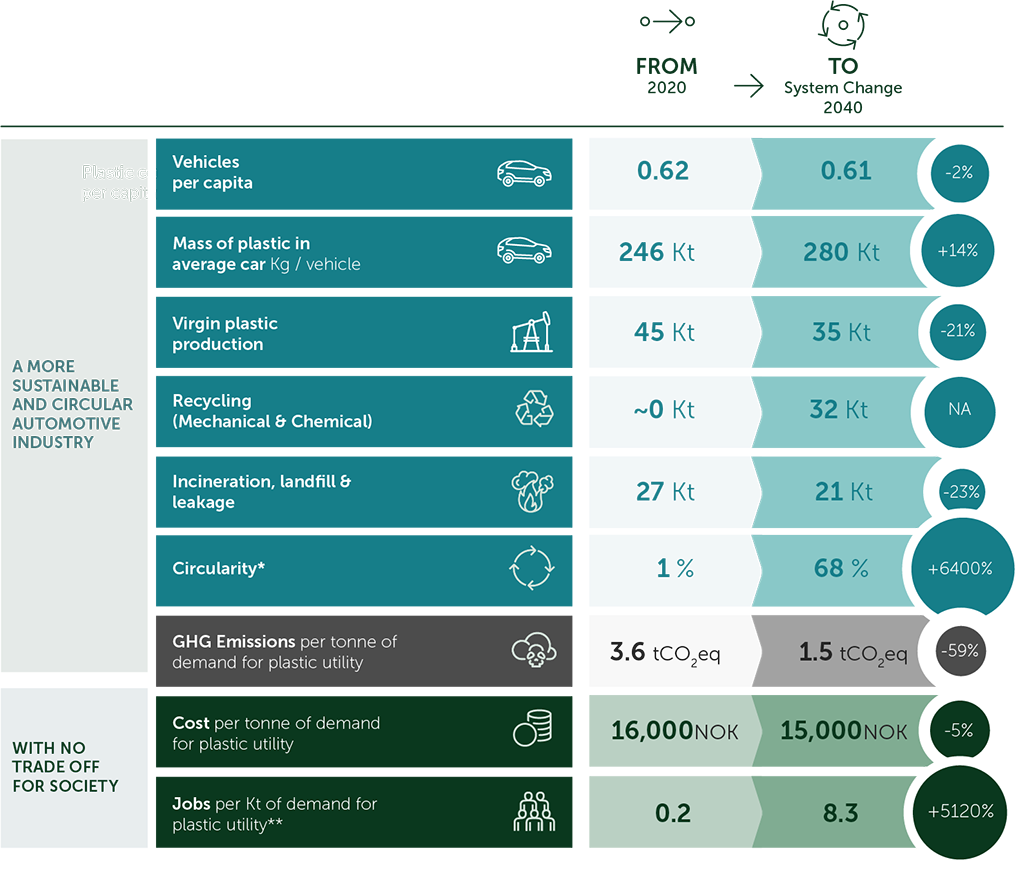

For all solutions, collaboration with Nordic countries (especially Sweden) will be key as Norway has no vehicle manufacturing facilities and the volumes are too small to justify the large investments in recycling infrastructure that are required. Our analysis shows that the sector can move from 1% to 68% circularity by 2040o, and virgin plastic demand could be reduced by 9,000 tonnes (~21%). In addition, ambitious application of these circularity levers alone could reduce the GHG emissions related to plastics in the automotive sector by 32% from 163,000 tonnes of CO2eq in 2020 to 111,000 tonnes of CO2eq by 2040.

EXHIBIT 20

Potential outcomes of implementing a System Change Scenario

Baseline:

Plastics in stock are accumulating in a highly linear system

As the population of Norway has become wealthier, the number of vehicles per capita has increased from ~0.42 in 1990 to ~0.62 today (compared to 0.56 on average in the EU)22 and this is expected to stabilise at ~0.68 vehicles per person by 2040.

At the same time, plastic content in vehicles globally has increased from ~160 kg/vehicle in 1990 to ~250 kg/vehicle today, an almost 60% increase. The use of plastics in vehicles has a number of advantages, namely its low density, fuel efficiency, low cost, durability, and safety benefits23. It is expected that plastic content will reach ~280 kg/vehicle by 2040, particularly with the trend towards larger cars and the rise of electric vehicles (EVs), due to their weight sensitivity and lower requirements for heat resistance. As a result of these trends, plastic has accumulated in the Norwegian vehicle stock, reaching an estimated 740,000 tonnes in 2020.

The rise of plastics has enabled greater levels of fuel efficiency and thus lower use-phase emissions, but it has also contributed to a decline in the recyclability and recoverability of materials from vehicles, essentially shifting the environmental burden from the use-phase to end-of-life.

Plastics have typically been used to substitute steel components in vehicles, which immediately reduces the probability of recovering the materials given the higher recycling rate of steel and the ease of separating steel from shredder residue relative to plastics. In addition, there has been a rise in the number of different polymers used, particularly engineering plastics, as well as greater use of composites and multi-material components, making mechanical recycling of automotive plastics extremely challenging. These design trends have led to a significant reduction in the recyclability of vehicles.

Although Norway is a frontrunner in the management of End-of-Life Vehicles (ELVs), the current system is still highly linear, with only 1% of plastic being dismantled (mainly bumpers) and reused or recycled. The remaining 99% is incinerated or landfilled.

A well-established ELV return system, introduced in the late 1970s, coupled with a successful scrap deposit system, has allowed Norway to successfully manage the whereabouts of ELVs, which has proven to be a challenge in the rest of Europe. However, beyond collection, Norway lacks the infrastructure required to close the material loops.

Norway has access to post-shredder technologies (PSTs) to recover metals, but there are no advanced PSTs in the region for recovering plastics from shredder residue. As a result, today only a marginal amount of

plastic from Norwegian ELVs is being recycled by companies like Stena and Norsk Gjenvinning. The application of advanced PSTs, while commercially available and continuously innovating, is not common practice given the lack of economic or regulatory incentives in most countries.

Current regulation lacks focus on plastics, but this is expected to change soon through the Revision of the End of Life Vehicle Directive, which is expected to include material-specific recycled content and recycling targets24. This step change in regulatory ambition is critical for driving investment in the infrastructure needed to recover automotive plastics at end-of-life. However, even with the current non-material-specific ELVD targets, the rapidly increasing share of plastics in vehicles means that there is a real risk of non-compliance unless some plastics are recycled.

As well as the lack of effective regulation and infrastructure, there are a number of other important barriers to circularity of automotive plastics, including the lack of design for recycling of automotive plastics to combat the rise in the use of complex composites and additives and the number of polymers; a lack of economic incentive to dismantle vehicles and recycle plastics given the high labour costs, high transport costs, and low resale value relative to low costs of disposal; and, given the industry’s high quality requirements and emphasis on aesthetics, the low uptake of recycled content.

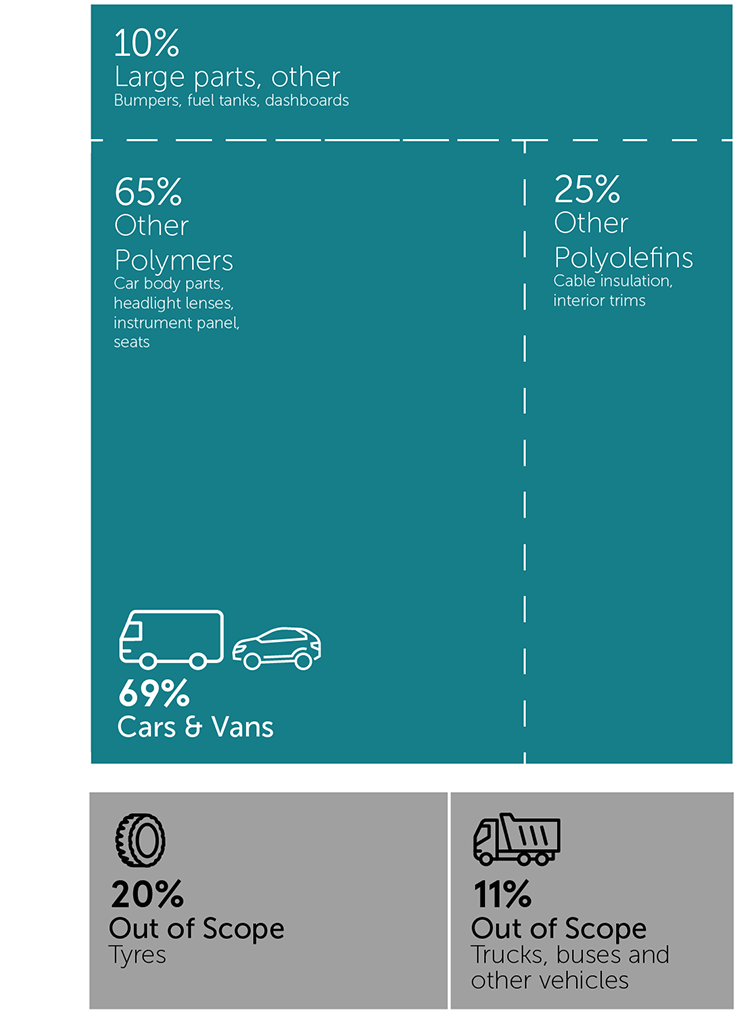

Tyres are not included in our modelling of the automotive sector, given their vastly different pathways and treatment routes, but they are important to consider due to the high volumes of plastic waste generated and high GHG emissions produced during their incineration, which is the dominant pathway for end-of-life tyres.

Tyres still contribute a large volume of waste in Norway, reaching 60,000 tonnes in 2020, of which around 46% (~28,000 tonnes) is plastic. Most of this plastic waste (92%) is currently incinerated, while only 8% is reused or recycled. Chemical recycling is expected to play a significant role in the treatment of tyres, and a number of pilot and small-scale plants are already emerging. For example, in Norway, Enviro Systems have developed a local plant which recycles tyres via pyrolysis.

Achieving Circularity:

Shared mobility solutions and scaling up advanced post-shredder technologies can change the trajectory

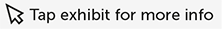

The automotive sector in Norway must pursue the ambitious deployment of circularity levers to reduce dependency on virgin fossil-based plastics and achieve a more circular system. Reduction in plastic consumption via the adoption of shared mobility solutions, as well as modal shifts, could eliminate 12% of plastic demand by 2040. Additionally, circularity levels of 68% can be reached by 2040. This relies almost entirely on downstream levers in the short term as the long lifetimes of vehicles in Norway (~18 years) means that the impact of design levers implemented over the next decade on waste generation is limited.

Shared mobility solutions and modal shifts have significant potential to scale in Norway, reducing vehicle demand per capita and thus demand for plastics. This is particularly true for cities like Oslo where there is evidence of these models already starting to take off. In smaller towns and more rural areas, there is less potential for these models. This change is not happening because of plastic, but plastic reduction is a co-benefit of this change.

Today, the average car is parked for at least 95% of its lifetime25, which is an extremely inefficient use of valuable resources. Shared mobility solutions such as Getaround and Bilkollektivet have the potential to change this, and the predicted rise in autonomous vehicles are likely to accelerate this trend. By introducing shared mobility models and incentivising modal shift, the vehicle stock could be reduced by 11% in 2040, relative to the baseline, resulting in a 12% reduction in demand for plastics.

EXHIBIT 21

Through the application of circularity levers the Automotive sector can reach 68% circularity by 2040

Design for recycling is critical for the automotive sector but the impact on recycling rates before 2040 is likely to be low. This involves the simplification and standardisation of polymer types and the reduction of composites and multi-material components.

Widespread adoption of design for recycling of vehicle components could reduce losses from mechanical recycling to a minimum of 15%, down from 30% today.26, 27 The trend towards reinforced plastics containing fillers and additives has made plastic vehicle components virtually impossible to mechanically recycle. By shifting to mono-material components, avoiding the use of paint, using fewer and standardised polymer types, and, where possible, avoiding the combination of different polymers altogether, much higher yields may be achieved in mechanical recycling and thus higher quality recyclates, driving a greater share of closed loop recycling.

Design for recycling in the automotive industry is already emerging, with some companies developing self-reinforced PP components that have the same or superior mechanical properties but allow for a straightforward recycling process.

Adoption of design for recycling relies strongly on the formulation of industry-wide standards, which must be strictly adhered to. While industry has a key role to play

in developing and enforcing these standards, policy support is required as the automotive industry is highly cost driven and to date has been optimising design for cost. The revised ELV Directive is expected to introduce material-specific recycling rates because the existing targets, which apply to all materials generally, have had little impact on plastics recycling given their relatively low share of total vehicle weight. This will place pressure

on OEMs to make recyclability of components a key criterion of their design.

In addition, the revision of the ELV Directive is likely to introduce mandatory recycled content requirements, a crucial requirement to minimise downcycling. Many OEMs are also setting their own recycled content targets (e.g. Volvo, with a 25% by 2025 recycled content target), and early adoption of design for recycling will be essential to secure a reliable future supply of high-quality recyclates.

EXHIBIT 22

The highest impact levers for the Automotive sector are Mechanical and Chemical Recycling

There is some potential for overall plastic demand reduction in the sector through the reuse of refurbished plastic components, but this is likely to be minimal and limited to repair only.

Given the time and labour-intensive nature of the process, dismantling rates remain low in Norway. But best practice examples in other countries, such as France, suggest that there is room for improvement, and there is already evidence of this happening in Norway, driven by the large cost differentials between new and used parts for the repair of vehicles.

By 2040, it is estimated that demand could be reduced by 4% relative to the baseline as a result of component reuse. The potential for reuse of plastic components is very much dependent on having modular, standardised vehicle designs, using non-destructive dismantling processes, and on the existence of re-sale channels for used parts, which are currently low but scaling in Norway. However, this is likely to be limited to replacing broken parts on cars in use, or insurance vehicles, rather than on new cars. It would also require technical specifications to remain static over the lifespan of the vehicle, or to become more flexible for certain components, particularly for non-safety critical components. Given these challenges, the potential for reuse is likely to remain low.

Driven by the desire to minimise vehicle weight and thus fuel consumption, the automotive sector has worked hard to optimise the use of plastics in vehicles. Further reduction of plastic content may be possible through future innovation28, 29, but is likely to be minimal, particularly with the rise in EVs, which are expected to see greater use of plastics to reduce overall vehicle weight in order to improve range.

Downstream levers are likely to have the most significant impact up to 2040. The key downstream levers in the automotive sector are the scaling up of advanced post-shredder technologies and chemical recycling.

Increasing recycling rates of automotive plastics relies predominantly on the scaling and improvement of advanced PSTs in Norway, as the dismantling of plastic components is limited due to economic and logistical challenges.

For this reason, most recyclers favour advanced PST over dismantling30 as, given the plastic quantities to be recovered, they are seen as more economically efficient. However, the dismantling of large components does have value in terms of enabling a cleaner stream of plastics and therefore should be pursued as far as the economics allow.

Given the significant investment required, widespread adoption of advanced PSTs in Norway relies on an improvement in the economics of recycling engineering plastics – including higher disposal costs and plastic recyclate prices, as well as strong policy incentives, which are expected to be introduced in the upcoming revision of the ELV Directive and, to some extent, by large industry players in the region such as Volvo who have started to show interest in closed loop recycling schemes.

At the same time, alternative disposal routes (i.e. landfilling and incineration) must become less attractive economically or be strictly limited by regulation. Given the volumes required to justify investment into these technologies, collaboration between Norway and neighbouring countries is critical.

Chemical recycling will also have a major role to play in the automotive sector, particularly in recycling plastics that are not recovered via advanced PSTs or that are not suitable for mechanical recycling.

While mechanical recycling is preferable to chemical recycling from a resource efficiency, energy and GHG emissions perspective, the challenges associated with sorting plastics from shredder residue limits its scalability. Even if all potential levers are utilised to their maximum potential and best practice is adopted across Europe, it is estimated only 35% of total plastic waste from ELVs in Norway would be mechanically recycled, producing ~20,000 tonnes of recyclate.

Mechanical recycling of technical plastics and plastic composites is technically challenging

as the properties of polymers in ELVs deteriorate during the use-phase due to UV exposure, wear and tear, etc., resulting in low quality recyclates. In addition, plastic components in vehicles typically have very strict specifications and require virgin quality material, particularly for safety-critical parts and exterior components that affect the aesthetics of the vehicle. Therefore, the potential for closed-loop mechanical recycling is limited. While there is some opportunity to use mechanical recyclate from other sectors, particularly consumable applications, this is also limited in terms of both the quantity and quality of the supply. Given these technical challenges, and the suitability of the shredder light fraction to thermal treatment, we expect chemical recycling to play an increasingly significant – though still complementary – role in this sector. In the System Change Scenario, ~22% of plastic waste, equal to ~13,000 tonnes is chemically recycled and recirculated back into the plastic system by 2040.

EXHIBIT 23

Key recommendations per actor

RECOMMENDATIONS

The Automotive sector should prioritise four main actions:

- Accelerating the implementation of new business models by shifting economic incentives (e.g. VAT, parking fees), with a particular focus particularly focusing on shared mobility solutions, as well as shifts towards other modes of transport including buses, e-scooters, cycling, etc.

- Policy interventions, particularly the revision of the ELV Directive to include material-specific recycling targets, combined with a requirement for the simplification and standardisation of polymer types and the reduction of composites and multi-material components.

- The scaling of advanced PSTs to enable local mechanical and chemical recycling.

- For all these interventions, collaboration with other Nordic countries (especially Sweden) will be key as Norway has no car manufacturers and waste volumes are relatively small.