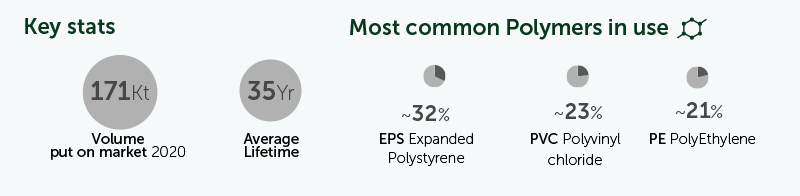

The use of plastic products in buildings and construction has grown rapidly over recent decades. Coupled with the long lifetimes of products, this has resulted in a significant accumulation of plastic in the Norwegian building stock, meaning that a large wave of plastic waste will emerge in coming years as in-stock volumes reach the end of their lifetimes and churn out as waste. By 2040, it is expected that the Norwegian construction sector will generate ~130,000 tonnes of plastic waste, representing an almost seven-fold increase relative to the 19,000 tonnes of waste generated in 2020.

The current waste-management system is ill-prepared to cope with these volumes, which could risk a significant increase in disposal, particularly incineration. To achieve higher levers of circularity, the most impactful lever is maximising on-site sorting of plastic waste to ensure clean material streams and thus a higher chance of material recovery. This should be coupled with the scaling up of sorting and recycling infrastructure to allow it to treat higher volumes of sorted waste.

Reuse and reduction opportunities via innovative building design should also be leveraged to minimise demand from the sector. However, these levers will have a limited impact on waste generation before 2040 given the long in-use lifetimes. Policy will need to play a pivotal role to guarantee the focus and speed required, and to prevent further urban sprawl due to Norway’s low population density.

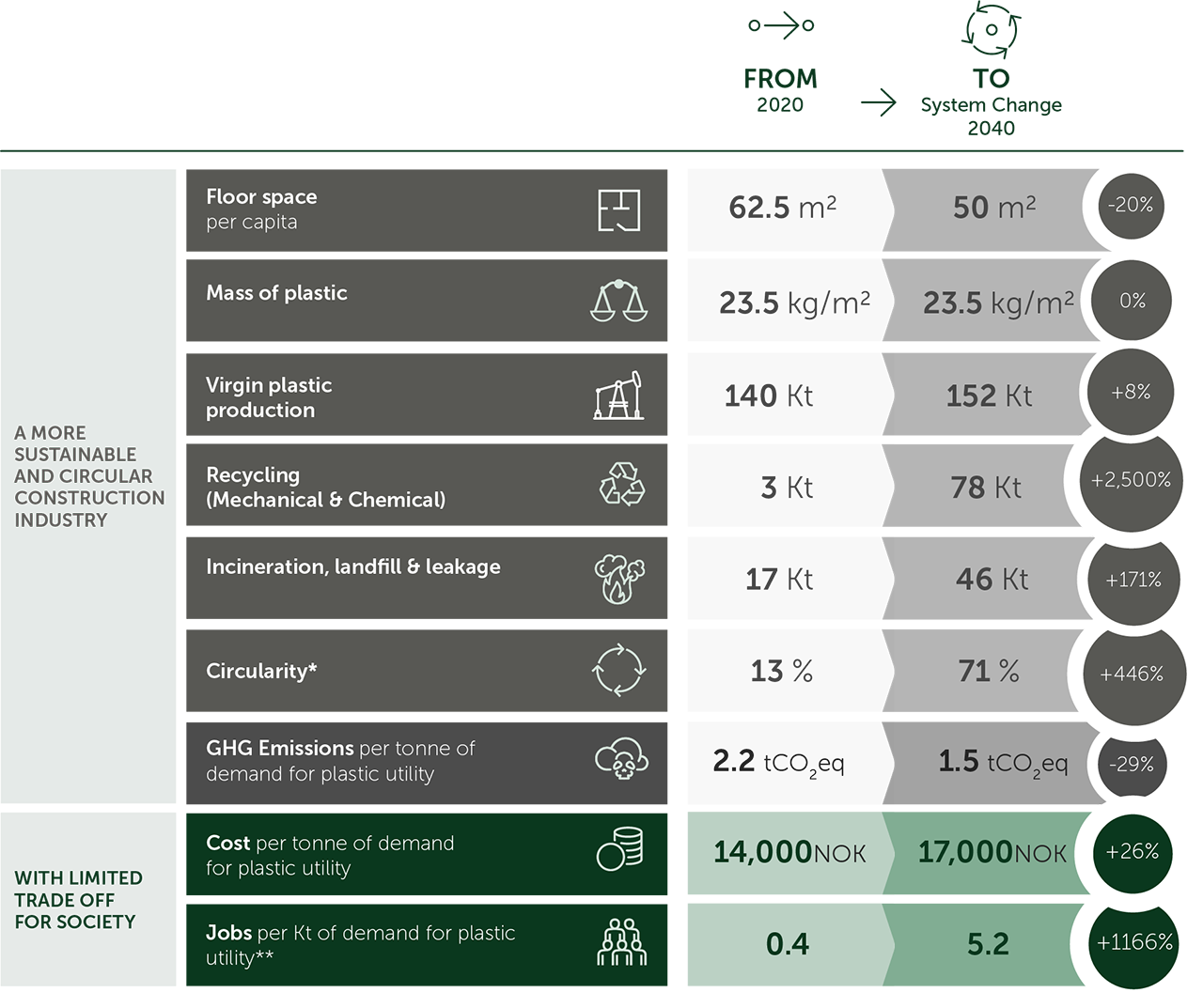

By applying these circularity levers the system can move from 13% to 71%h circularity by 2040, while the proportion of plastic demand met by virgin production can be reduced to 67% by 2040, down from 82% today.

However, even with the ambitious deployment of circularity solutions, GHG emissions related to plastics in this sector are set to grow by 8% (from 371,000 tonnes of CO2eq in 2020, to 402,000 tonnes of CO2eq by 2040) in the System Change Scenario (Exhibit 8). This is much lower than the estimated 92% emissions growth (to 713,000 tonnes of CO2eq by 2040) in the Baseline Scenario.

EXHIBIT 8

Potential outcomes of implementing a System Change Scenario

Baseline:

Norway unprepared to cope with the upcoming wave of plastic waste

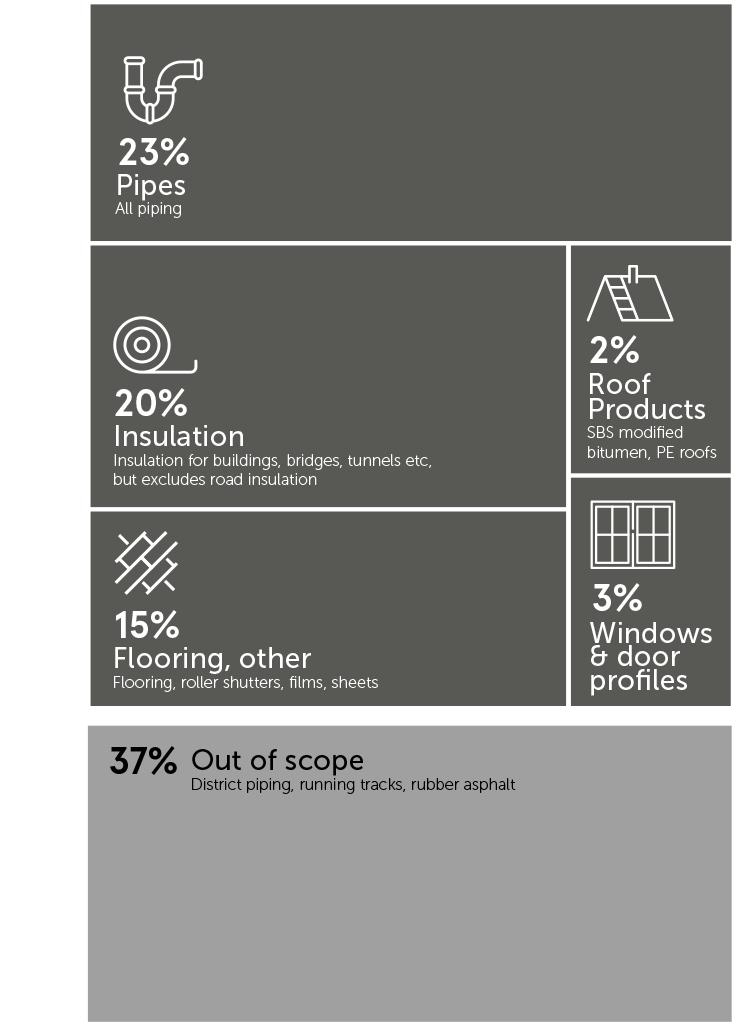

The construction sector represents the second largest end use market for plastics in Norway after packaging (171,000 tonnes in 2020), yet this sector is currently the smallest source of plastic waste (19,000 tonnes in 2020) out of the five sectors considered in this report due to long lifetimes of construction products.

Plastic demand in the Norwegian construction sector has grown significantly in recent decades, driven predominantly by increased plastic usage per square metre to around 12-21 kg/m2,1 as well as by population growth and increasing floor space per capita2.

This trend has also been seen globally, with plastic consumption from the sector growing at an average rate of 4.3% per year over the last two decades.3 In Norway, a growing trend towards the import of low-cost products has contributed to rising consumption of plastics and led to the substitution of other materials (e.g. timber, aluminium, and mineral wool) with plastics.

The rapid growth in plastic demand from the sector, coupled with long product lifetimes, has resulted in a large accumulation of in-stock plastic, reaching an estimated 2.7 million tonnes by 2020. We can therefore expect a large wave of plastic waste from the construction sector over the coming decades.

Current demand volumes are almost 9 times higher than waste volumesi, which means we expect an estimated 7-fold increase in waste volumes by 2040 as the large in-stock volumes begin to churn out as waste. Norway’s current waste collection, sorting and recycling infrastructure are entirely underprepared to cope with these volumes of waste. Under current policy and environmental conditions, this could lead to a large increase in disposal, particularly incineration, leading to unacceptable levels of GHG emissions.

Plastic accounts for less than 1% of construction and demolition waste. Its low volume, coupled with the economic and logistical challenges associated with the separate collection of plastic waste has limited on-site sorting of plastics to date.

This is the main barrier to circularity today, with only 13% of plastics currently recycled from building and construction. Construction plastics are often embedded in the building, for example behind walls and under floors and roofs, and firmly attached, such as to flooring

using adhesives, or to windows that need to be dismantled separately. This poses a challenge to on-site sorting and often results in the use of destructive demolition techniques that do not allow for the recovery of clean plastic waste streams. In addition, there is a lack of economic incentives for plastics recovery, given the low value of secondary plastics relative to building materials such as steel and timber, as well as high labour costs. This has led to a preference for speed of demolition over plastic recovery that limits system circularity.

In addition to the economic and logistical challenges associated with the recovery of plastics from construction and demolition, another key barrier to circularity is the presence of legacy additives and substances of concern that were used prominently in many building products in the past but are now regulated against. Plastics containing these substances cannot be recycled and put back on the market.

There is currently limited policy focus on construction plastics but movements in other sectors signal growing momentum towards more stringent policy.

There are no mandatory requirements for separate collection or recycling of plastics from construction and demolition in Norway and, given the low costs of disposal and incineration, no economic incentives. Voluntary initiatives exist, such as the Nordic Swan Ecolabel, which sets standards on building materials, best practices on demolition, on-site sorting, etc., but, given the lack of policy

mandate and the poor economics, these initiatives are poorly subscribed to. While the Waste Framework Directive mandates that 70% of construction and demolition waste must be recycled or reused, the relatively low volumes of plastic waste mean that it is not typically a target material for achieving this mandate. However, there are positive signals indicating that the EU, via the Circular Economy Action Plan, and Norway, via its national plastic strategy, are likely to propose new requirements for plastics recovery from construction and demolition in the near future.5

Achieving Circularity:

Innovative building design and reuse, coupled with on-site sorting can change the system

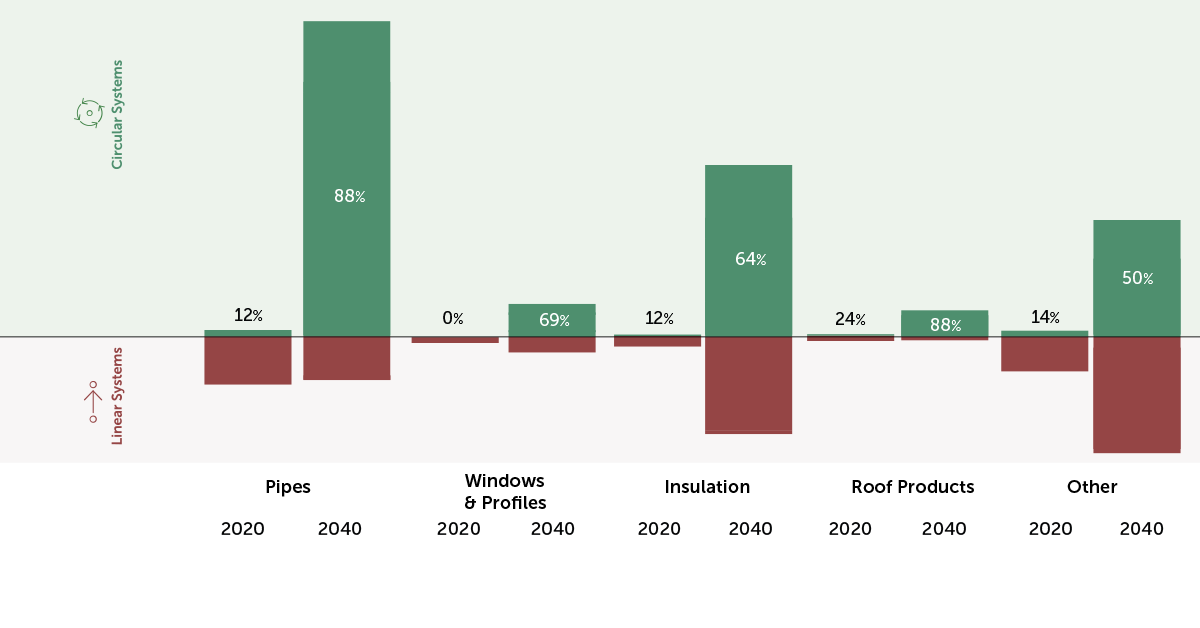

EXHIBIT 9

Through the application of circularity levers the Construction sector can reach 71% circularity by 2040

A level of 71% circularity can be achieved by 2040 (57% without chemical recycling), mainly by maximising the on-site sorting of plastic waste to ensure a clean material stream, and thus a higher probability of material recovery in downstream sorting and recycling stages.

Additionally, sorting and recycling infrastructure should be scaled rapidly, both in Norway and the wider region, to treat the much higher volumes of sorted waste, as well as to cope with rapid growth in plastic waste. Reuse and reduction opportunities via innovative building design should also be leveraged to minimise demand from the sector.

These levers can eliminate around 11% of plastic demand by 2040.6

Downstream levers are most important in the near-term. These rely on a rapid expansion of sorting and recycling capacity in Norway. Sorting capacity is required to increase by 13-fold by 2040, rising from 4,000 tonnes to 44,000 tonnes. Similarly, mechanical recycling capacity is required to scale to support the 16-fold growth in recycling feedstock (56,000 tonnes by 2040) from the construction sector.

The single most impactful lever to increase circularity is maximising on-site sorting of plastics to enable separate collection.

It is widely documented that separate collection and sorting of construction products on site leads to cleaner, uncontaminated materials. This is clearly exhibited by the success of existing separate collection schemes in the industry, for example under the VinylPlus framework.

According to a report by Plastics Europe7, separately collected plastic waste is ten times more likely to be recycled than mixed waste. This is particularly relevant in the construction sector where the concentration of plastics in mixed construction and demolition waste (consisting of rubble, bricks, etc.) is extremely diluted.

Due to the current logistical and practical challenges associated with on-site sorting, maximising the separate collection of plastic waste requires better data on two fronts:

- More data is required on what materials are contained within buildings, for example through the use of digital building passports that log the composition of the building and the components/materials used, or through pre-demolition audits. While there is a mandatory requirement to carry out these audits in many EU member states, including Norway, this is rarely enforced.

- Monitoring schemes that increase understanding of what collection rates are today are needed in order to allow for benchmarking exercises and set industry wide targets. A number of effective schemes have already proven that increased collection of plastics leads to higher recycling rates (e.g. Europe-wide schemes that are part of VinylPlus such as Recovinyl, REWINDO in Germany, etc.).

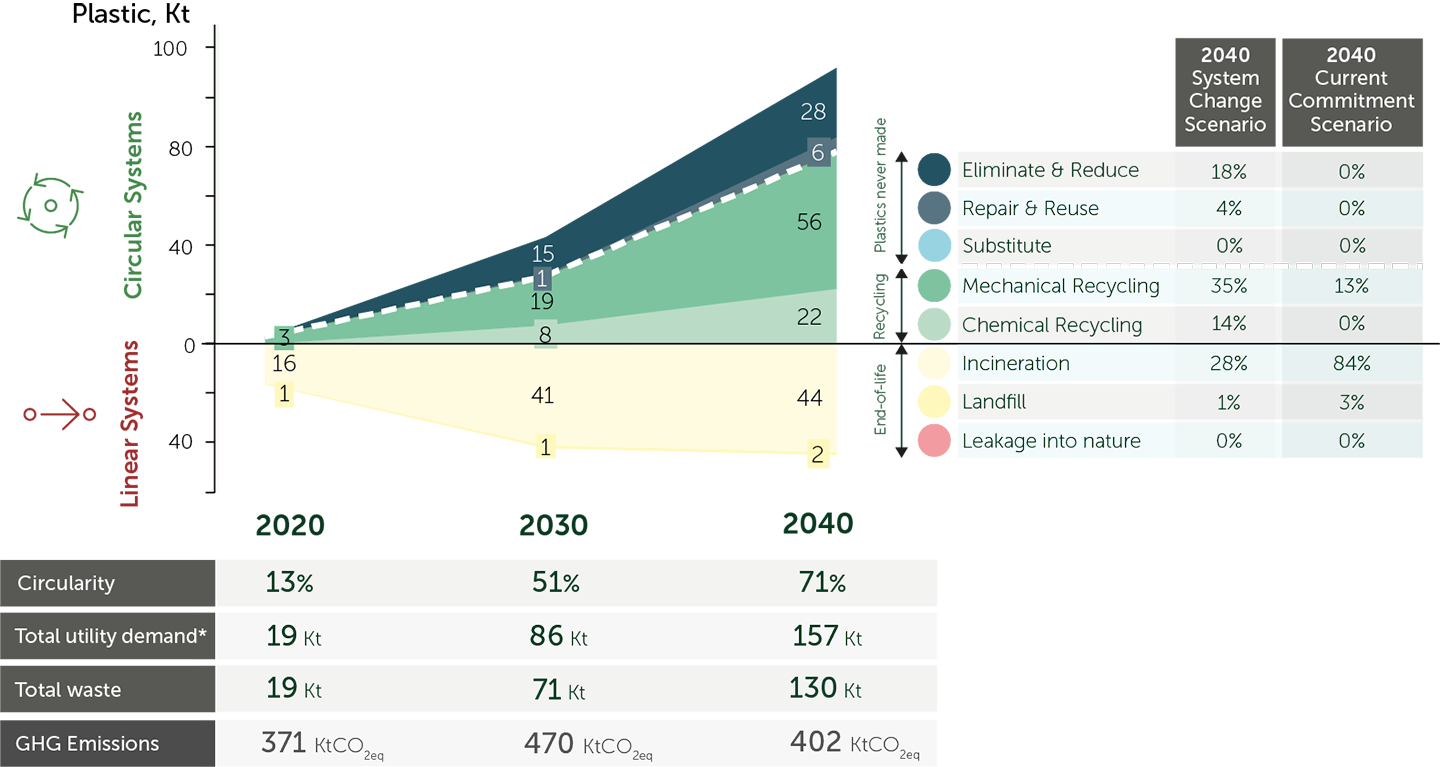

EXHIBIT 10

The highest impact levers for the Construction sector are Mechanical and Chemical Recycling

Policy will have an important role to play, for example by setting material-specific collection rates, and by mandating and enforcing the use of building passports. Finally, economic incentives need to be put in place to enable greater focus on on-site sorting. Essentially, the cost of unsorted waste must increase to above that of on-site sorting and disposal rates must increase to incentivise on-site sorting. Other circularity levers are important but will be ultimately futile without increased on-site sorting.

Under a fully optimised system, with on-site sorting in place, mechanical recycling could account for 43% of total plastic waste generated by the building and construction sector in Norway by 2040.

This can only be achieved if separate collection becomes common practice. An improvement in sorting and recycling yields, through the upgrading of current technologies (e.g. to robotic sorting), can allow for some incremental improvements in recycling rates. As demonstrated by Finland-based ZenRobotics, robotic sorting has significant potential for sorting large and heavy plastic fractions. Commercial plants already using these technologies have achieved sorting losses as low as 10%. In addition, robots enable uninterrupted sorting and 24/7 operations, increasing the capital efficiency of sorting plants. The adoption of these technologies would also make decentralised operations possible, reducing transport costs and increasing the likelihood of sorting in more remote areas.

Building out mechanical recycling capacity in Norway relies on significant investment in the sector but potential will be limited in the short term due to the technical challenges associated with dealing with waste from volumes put on the market decades ago. Many polymers that are now emerging as waste contain legacy additives (e.g. PVC contains the heavy metals cadmium and lead) that are now heavily regulated against. By 2040, the majority of plastic waste containing legacy additives should have churned out of the system.

Design for recycling and dismantling, through standardising component design, polymer types and colouring, easier material separation, and avoiding additive content – particularly additives with a high potential for being regulated – will improve the business case for mechanical recycling in the future.

Stimulating the use of recycled content is also key. Construction is particularly well suited to leverage low-quality, low-cost recycled content as there are no food-grade and aesthetic requirements. A good example of this is Statsbygg, the Norwegian government’s building commissioner, property manager and developer, encouraging the use of recycled content and already using 20 tonnes of recycled plastic in three different projects.

Chemical recycling is particularly relevant for plastic waste from the construction sector due to the legacy additive content.

This waste is not suitable for mechanical recycling and is therefore typically disposed of; however, chemical recycling technologies can filter out additives to recover pure monomers, although this still requires sorting and cleaning prior to recycling. This analysis estimates that only a limited amount of construction waste can be chemically recycled before 2030 (~8,000 tonnes), but that this can grow to around 22,000 tonnes by 2040, covering ~14% of the circularity solution for construction in Norway. However, there is a high level of uncertainty around the future of chemical recycling and its costs. Wherever possible, all other circularity levers should be prioritised first.

It is important to begin implementing upstream levers – such as design for recycling, modular building design, and component standardisation – this decade, but they will have limited impact before 2040 due to long in-use lifetimes. A crucial demand reduction lever is the shift towards the renovation and refurbishment of buildings, instead of new builds, which thus reduces both the plastic waste generated by the sector and the demand for new components. However, the reuse potential of plastic components is limited to certain applications where modularity and standardisation are feasible. For this to work, modular design, standardisation, non-destructive demolition practices, and the scaling of takeback schemes need to be implemented. There are

already good examples of small schemes trying to scale takeback opportunities, including Bewi and Vartdal Plast AS for EPS insulation, Tarkett for PVC flooring, Interface AS for old floor tiles, and Protan for roofing materials.

Additionally, designing buildings and components for deconstruction to preserve the structural integrity of plastics as far as possible and enable clean, non-destructive dismantling will be key.

Norway has significant potential to use buildings more intensively through efficient, more compact design, enabling an 11% reduction in floor space per capita, and an 11% reduction in plastic demand relative to

the Baseline Scenario in 2040.7 This involves the scaling of sharing models and the use of flexible, multi-purpose building designs. One approach that is gaining traction is through well-known services such as Airbnb and co-working communities. Working from home flexibility enables the reduction in office space, and there are many co-benefits to more compact living, including reduced energy requirements for heating and lighting.

Limited potential for substitution has been identified in this study. This is due to the many use-phase benefits that plastic delivers in the construction sector, its low relative cost, and the limited number of suitable substitute materials. Timber is already widely used in Norway for flooring, structures and coverings, profiles, etc., and it is assumed that there is limited opportunity to increase this further, particularly given the cost-sensitive nature of the sector.

EXHIBIT 11

Key recommendations per actor

RECOMMENDATIONS

The Construction sector should prioritise three main actions:

- Encourage renovation over new build and shift to more compact and efficient living.

- Introduce ambitious, dedicated policies for plastic waste in Construction & Demolition, focusing on requirements for on-site sorting.

- Prepare for on-site sorting of plastics and scale up waste management systems.