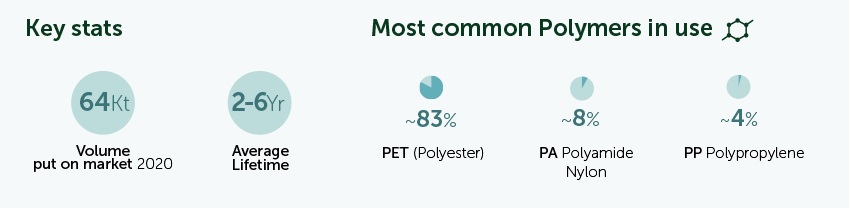

Plastic has become central to the fashion, industrial apparel, household textiles and outdoor life industries. Today, Norwegians consume ~13kg of plastic in textiles per person per year and, in 2020, Norway had ~670,000 tonnes of textiles in usej, of which ~55% was plastic.8,9

A combination of increased consumption, lower usage per item, and the prominent use of less recyclable multi-fibred or multi-layered garments (a third of all textile waste is unsuitable for fibre to fibre recycling)10 has led to the textiles sector becoming the second largest generator of plastic waste annually, after packaging.

Initial steps have been taken to create a more circular system, from the industry developing design principles to pilots testing how all discarded textiles can be collected by 2025. But although momentum is building, additional supply side regulations (such as the EU’s objective to introduce mandatory performance requirements for textile products by 2024) and an EPR policy (currently being discussed in Norway) will be needed to accelerate the transition.

As Norway is a net importer of textiles, with less than 5% local production, the country has limited control over upstream solutions. Close collaboration with the EU, targeting the production phase and supporting international rules and standards, is therefore vital. In combination with demand side reduction through reuse and repair business models, and downstream levers, this can unlock a well-functioning circular system.

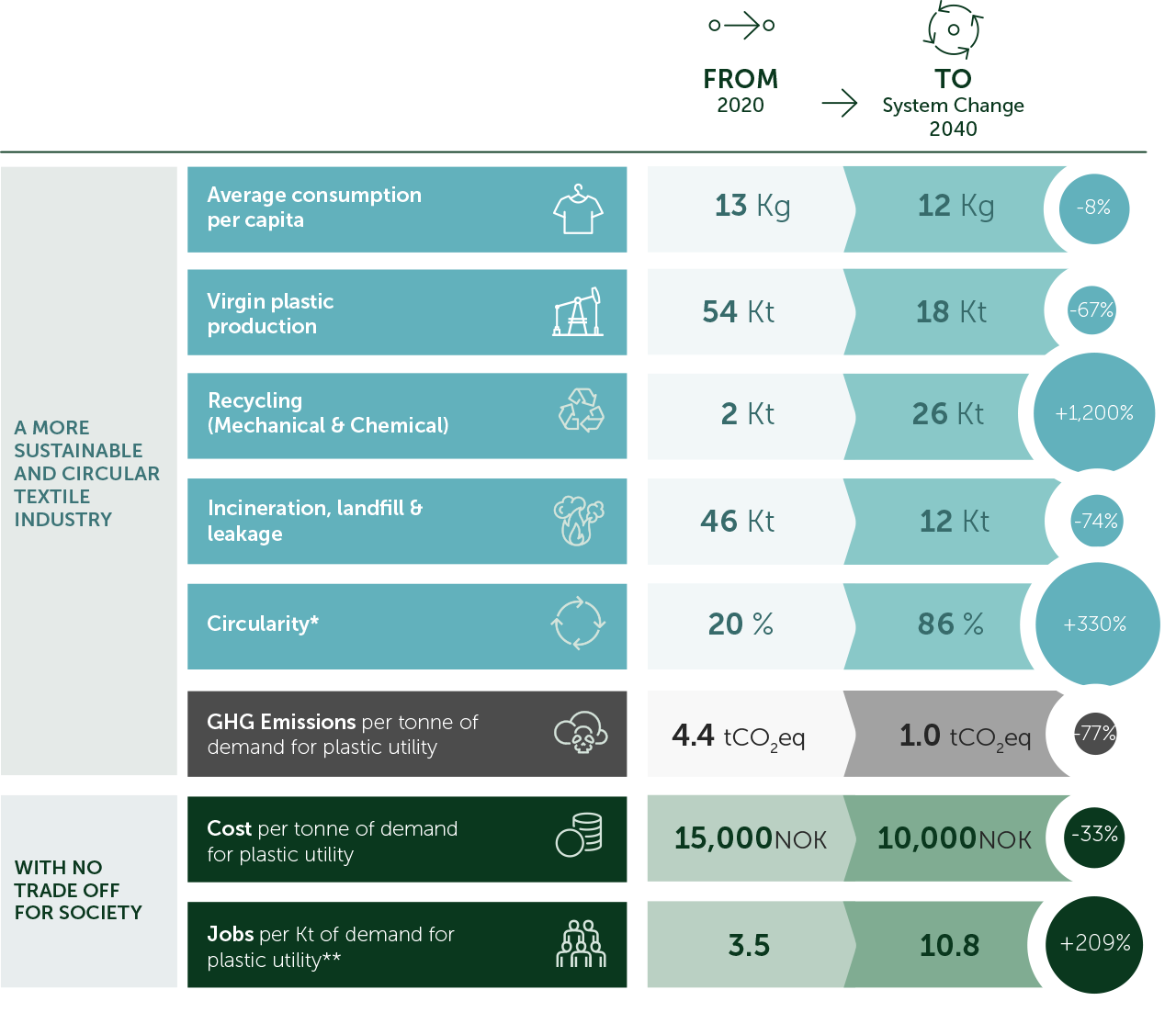

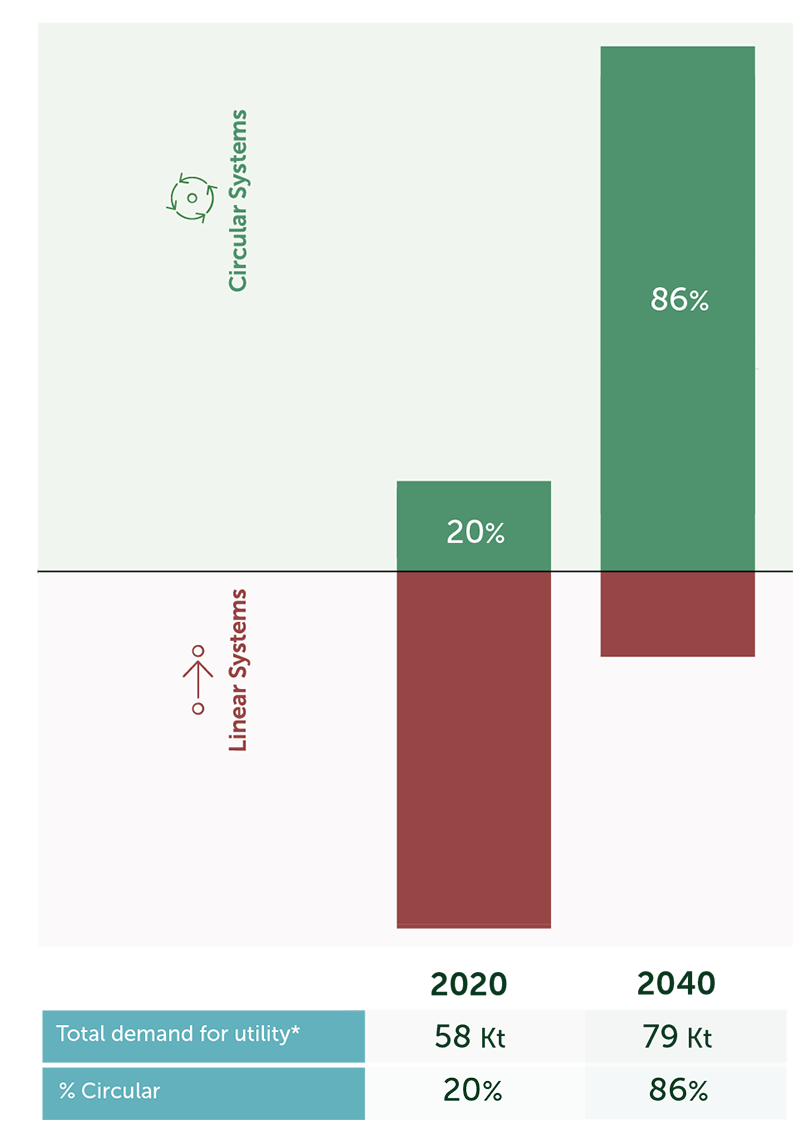

Our analysis shows that, by applying circularity strategies, annual virgin plastic consumption can be reduced by ~34,000 tonnes (74%), and a transition from 20% to 86% circularityk can be achieved by 2040. GHG emissions related to plastics in textiles can be reduced from ~200,000 tonnes of CO2eq by 2040.

EXHIBIT 12

Potential outcomes of implementing a System Change Scenario

Baseline:

A linear system highly dependent on exports

Although there are some signs that consumers in Norway are becoming more conscious about their consumption, fast fashion remains prevalent and annual utility demand across all product categories is expected to grow by 24% by 2040 compared to 2020.12

Product categories in scope are highly linear, with ~80% of total plastic waste currently incinerated and a small proportion landfilled.

In terms of circularity, ~17% of total waste is reused. Around half of this is exported to other countries in Europe, 34% is exported to Africa, and 17% to Asia13. This strategy has been important to Norway as today’s textile collection points, managed by NGOs, have built supporting infrastructure that will further improve circularity in the future. Besides reuse, a small proportion (~3%) of total textile waste is exported to be recycled outside of Norway.

Norway has set targets to significantly increase dedicated textile collection by 2025, in line with the EU Waste Framework Directive.

The Norwegian Fashion & Textile Agenda (NF&TA) is testing several pilot systems aimed at a collection rate of 80% of textile waste by 2025, compared to the ~23%11 collection rate today. This is a key starting point to achieve higher levels of circularity.

However, Norway runs the risk of losing valuable, carefully collected secondary materials to other markets unless advanced local sorting, pre-processing and recycling facilities are developed.

A sector specific EPR regulation and a system for eco-modulated fees will make a significant difference.

Even though no details have yet been communicated, initial EPR policies for textiles are expected to be included in the 2023 revision of the Waste Framework Directive. These are expected to include design guidelines from 2024, and policies to prohibit the incineration of overstock, and recycling and/or repair and reuse targets, by early 2025.

Key barriers to circularity that EPR and other policies will need to tackle include:

- Fast fashion credo, including high turnover rates of seasonal collections and over-production to reduce cost per item. Today, the overproduction and overstock volumes and mishandling of unsold commerce is underreported. This is amplified by a tax system that disadvantages recycling (additional taxes and administrative costs) over the incineration of unsold textiles.

- Taxes on repair and resell services, including administrative work involved.

- Lack of trustworthy information about the textile products, their components, and their environmental footprint14.

- Textile quality and recyclability: sorting and recycling centres have noted a decreasing textile quality– limiting lifetimes and contributing to a decline in recyclability and recoverability – caused by an increase in multi-fibred and multi-layered textiles which are unsuitable for sorting and recycling, as well as fibre shedding during washing and drying and general wear and tear.

- No at-scale technologies for fibre to fibre recycling: while fibre-to-fibre recycling is currently being tested (e.g. depolymerization of PET), it is far from being implemented at a commercial scale and is inhibited by low textile quality and recyclability, and the complexity of different fibres.

- Low economic value of secondary materials due to the mixed fibre composition and limited availability of quality recyclates.

- The need for pre-processing and sorting: currently the collection and sorting value chain are highly fragmented with high inconsistencies and low sorting accuracy14.

Achieving Circularity:

Sharing, repairing and recycling

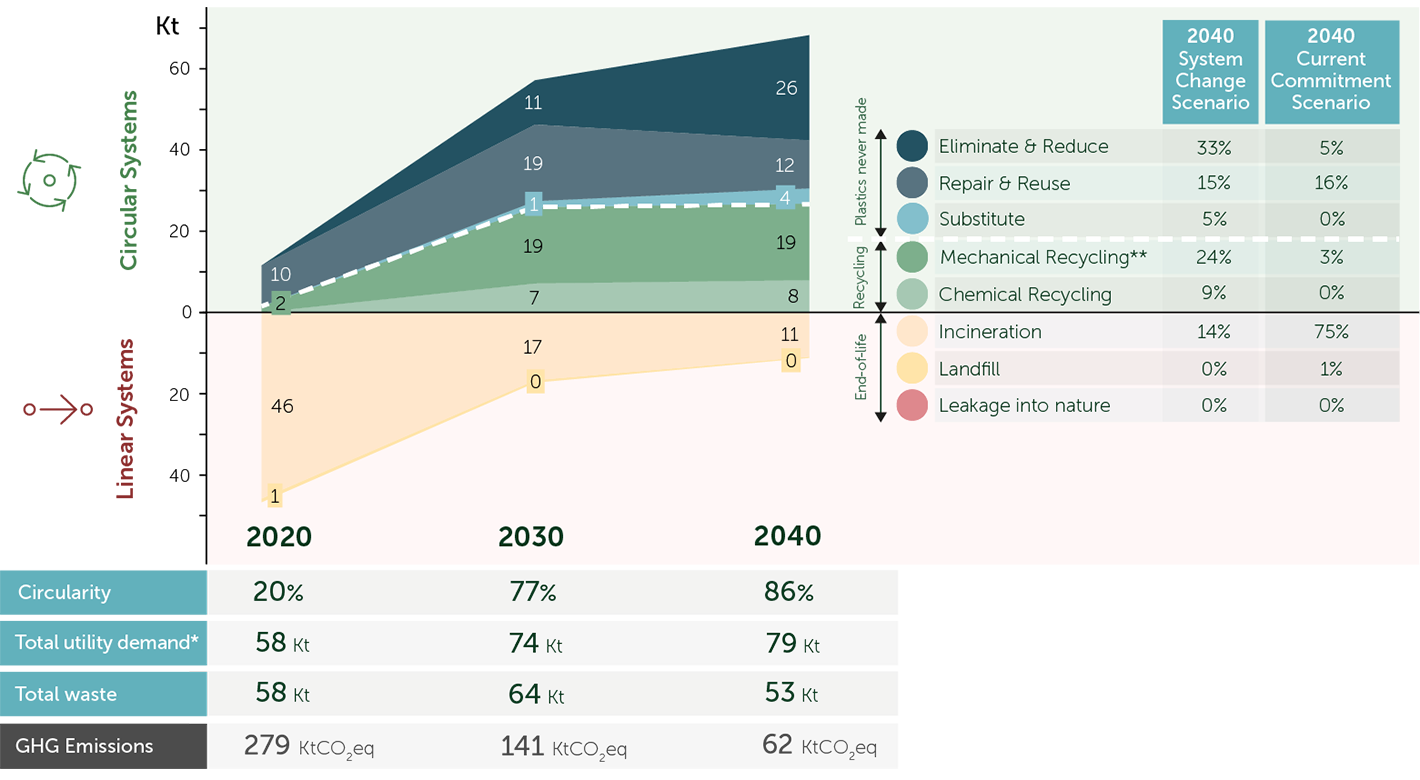

EXHIBIT 13

Through the application of circularity levers the Textiles sector can reach 86% circularity by 2040

Through the application of circularity strategies circularity levels could increase up to 86% by 2040 (Exhibit 13). Improving overall textile quality and reducing the complexity of fibre composition through design guidelines and regulations will be essential enablers for all circularity measures.

There are two key upstream levers:

Firstly, facilitating and encouraging sharing and reuse business models, like rental, second-hand and repair, could reduce 20% of virgin plastic demand by 2040 and extend the average lifetime of textiles by 1.7 times, based on average length of second-hand ownership14.

Globally, ~48% of GenZ l and Millennials and ~35% of GenX are willing to buy second-hand, with a ~1/3 intention-action gap14. In their 2030 vision, the EU strategy for sustainable and circular textiles emphasises the importance of making profitable reuse, rental and repair services widely available. Guidelines like the eco-design directive for durability, repairability and recycling, and a possible ban on the destruction of unsold textiles, will be critical enablers to turn this strategy into a reality. In Norway, sharing, resale and reuse models are starting to gain traction, with local examples including tise.com, finn.no, fjong.no, and levd.no for kids.

Another lever is the introduction of fewer and smarter seasonal collections (i.e. moving from fast to slow fashion), multi-functional garments, and reducing overproduction. This has the potential to reduce demand for virgin plastic by 10% in 2040.

Today’s fast fashion credo dictates at least four seasonal collections, with short turnover periods and frequent rotations of what is on display. The EU Strategy for Sustainable and Circular Textiles states in its 2030 vision that fast fashion needs to be out14.

Some large industry players are working towards fewer seasonal collections with less distinct colours and patterns, which is expected decrease overall demand and overproduction. Smarter seasonal collections, preceded by a test phase using e-testing or pre-ordering are expected to further reduce unnecessary production due to better design and fit. However, as not all brands will be willing to make these changes voluntarily, effective policies will be key, including to financially disincentivise overproduction. A local example of a company already applying this is Moiré.

Accurately quantifying overstock/ overproduction in Norway is difficult, due to underreporting and mishandling. As a reference, globally ~40% of garments are sold at markdown price due to overproduction. Fewer seasonal collections and investments in new technologies for demand forecasting and stock management have the potential to reduce industry wide overproduction, in combination with economic or regulatory incentives. France is currently the only European country with regulation in place to ban the destruction of unsold fashion by 202314. This needs to be a clear objective in the EPR for textiles.

Besides these upstream levers, there are two key downstream levers.

Firstly, the scaling up of collection, sorting, and pre-processing infrastructure. Under the EU Waste Framework Directive, Norway must work toward increasing the dedicated collection of textiles by 2025 and is currently testing the best way to achieve this. However, without improved downstream measures like sorting, pre-processing, and recycling facilities, Norway runs the risk of mismanaging these carefully collected textiles.

By establishing higher collection rates, more textiles will be available for reuse and recycling domestically. This development is expected to reduce the share of collected and subsequentially exported textiles in Norway in 2040 to a quarter of the 2020 export levels.

To enable reuse and recycling, the development and implementation of automatic sorting technologies like NIRS scanning, that detect materials as well as fibre composition, fibre quality and colours in waste streams, is essential14. Sorting needs to be accompanied by pre-processing to handle the removal of zippers, buttons, etc., which can be

integrated into sorting or recycling facilities. Pre-processing remains costly and complex, but this can be tackled with regulatory incentives and should be addressed in the EPR for textiles.

Regulatory incentives, like prohibiting the export of unsorted textile waste outside of the EU, as well as increasing requirements for sorting accuracy to meet recycling rates, will drive the consolidation of the fragmented sorting landscape and increase the share of textiles available for reuse and recycling to 78% of total waste by 2040.

EXHIBIT 14

The highest impact lever for the Textiles sector is Reduction driven by opportunities for new business models, including sharing

The second key downstream lever is recycling, both domestically and in close collaboration with other Nordic countries, which has the potential to represent 33% of total circularity by 2040. The proportion of closed loop recycling (i.e. fibre-to-fibre) is highly dependent on new technologies (e.g. PET depolymerisation) and design for recycling.

Currently, only ~3% of total waste is recycled through open loop recycling into non- woven products, which mainly takes place outside of Norway.

Beyond collection, sorting, and preprocessing, the main enablers to reach higher recycling rates are new recycling technologies (e.g. PET depolymerization) and design for recycling that reduces complexity and standardises fibre composition.

Fibre-to-fibre recycling of polyester (PET) does not yet exist at scale, but several technologies are currently being piloted, including in Norway and Sweden. Today, recycling is limited almost exclusively to the downcycling of polyester, and this is expected to remain the case for mechanical recycling.

As properties of polymers deteriorate during washing and drying, as well as due to wear and tear, feedstock is often inadequate for recycling. The adoption of industry wide design standards will rely heavily on regulatory and economic incentives. Although design guidelines to increase recyclability and recoverability of textiles are being broadly discussed today, their application is still in pilot stages and will need to be addressed in the EPR for textiles14.

While there is some opportunity to use recyclate from other sectors to produce recycled fibres, particularly consumable applications (e.g. rPET – plastic from bottles), this is also limited in terms of quality of the supply. Additionally, the expected increase in closed loop recycling of consumables by 2040 will limit access to recylates from this sector.

The EU Strategy for Sustainable and Circular Textiles prioritises fibre-to-fibre recycling rather than bottle-to-fibre, as the quality of recylates determines future recoverability and recycling rates. However, as mentioned above, at scale closed loop recycling technologies are not yet available. Therefore, it is important that circularity strategies and future regulations for textiles target mandatory closed loop recycling rates to limit downcycling within the sector.

Finally, chemical recycling is expected to play an increasingly significant yet complementary role to mechanical recycling. In our analysis, chemical recycling was found to be the most likely route to fibre-to-fibre recycling of polyester at scale. Chemical fibre-to-fibre recycling rates are expected to increase from virtually zero today, to ~8,000 tonnes of total waste by 2040, and then recirculate as recyclates back into the sector.

The volume of textile waste streams in Norway are big enough to justify domestic recycling, and is expected to be sufficient to

operate domestic recycling hubs, given economic viability. However, collaboration with other Nordic countries to develop competitive sorting and recycling hubs could be more economically efficient and allow for knowledge sharing.

It is important to highlight that there are ongoing discussions about what is considered waste in the textile sector. The EU currently has regulations in place to regulate exports to non-OECD countries, and there are efforts to close the gap on missing recycling capacity in Europe, e.g. through the Horizon Europe programme.

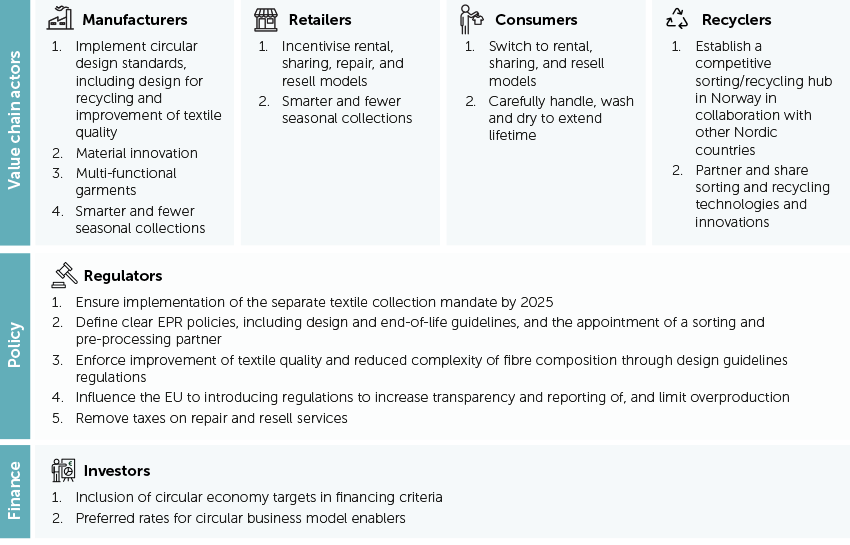

EXHIBIT 15

Key recommendations per actor

RECOMMENDATIONS

Three main actions can move the needle towards circularity:

- Application of circular design principles.

- Implementation and scale up of new rental, resale and repair business models that ensure each owner extends the use-phase.

- Establishment of a competitive sorting and recycling hub, either in Norway or in collaboration with other Nordic countries.