Global demand for electrical and electronic equipment (EEE) has risen rapidly over the last century and Norway is no exception, with a 15% growth in demand in the last decade alone. Given the sector’s dependency on plastics, this has led to rapid growth in plastic consumption and waste generation, making Waste from Electrical and Electronic Equipment (WEEE) the 4th largest source of plastic waste in Norway.

While WEEE recycling rates are high compared to most other sectors, the system remains predominantly linear, with over 20% of WEEE unaccounted for at end-of-life15. WEEE is also responsible for the largest share of plastic left in nature as a result of industrial cables often being left underground. Currently, ~30% of WEEE plastics is recycled annually through a well-functioning network of WEEE collection centres and recycling facilities. However, less than 1% of WEEE is recovered for reuse, despite significant potential for repair and refurbishment.

To achieve higher levels of circularity, leakage of waste must be reduced by maximising formal collection, with a particular focus on reuse; adopting design for recycling principles to reduce and standardise the types of polymers and simplify the sorting process; and directing investment towards scaling innovative sorting technologies that yield higher recovery rates.

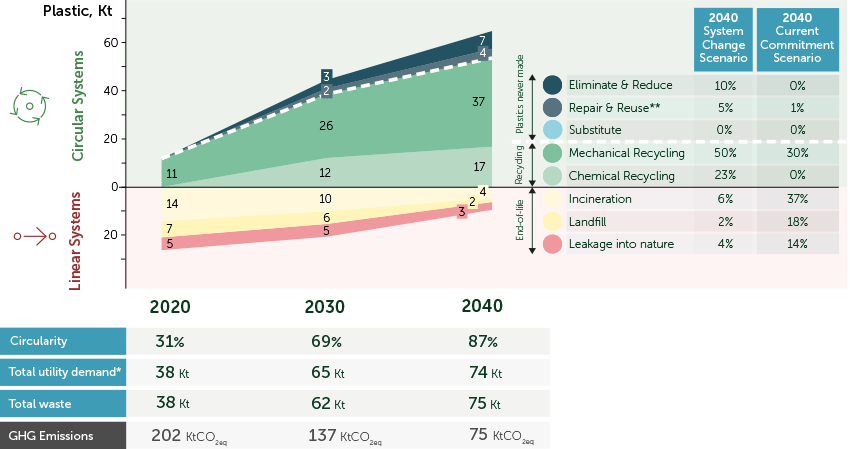

Through the application of these levers, this sector can reach ~87% circularitym by 2040, and reduce virgin plastic consumption by ~39,000 tonnes (58%). At the same time, these circularity levers can reduce annual GHG emissions related to plastics in the sector by 63%, from 202,000 tonnes of CO2eq today to 75,000 tonnes by 2040 (Exhibit 16).

EXHIBIT 16

Potential outcomes of implementing a System Change Scenario

Baseline:

Lack of control at end-of-life

The EEE sector is highly diverse, with products ranging from consumer-facing electronics like mobile phones and TVs, to large industrial cables installed underground. The challenges faced are unique to each product category and solutions must be tailored to meet the specific needs of different product groups.

This sector is the 3rd largest consumer of plastics in Norway, at ~71,000 tonnes in 2020, and is the 4th largest source of plastic waste, accounting for ~38,000 tonnes of waste.

The inappropriate handling and treatment of WEEE represents a serious environmental, social, and economic threat. There have been a number of regulatory attempts to alleviate these challenges, including the European WEEE Directive, introduced in 2003 and revised in 2012 with the aim of maximising the recovery of valuable resources through reuse and recycling, and reducing environmental impacts caused by inappropriate treatment, littering and leakage into nature.

The inappropriate handling and treatment of WEEE represents a serious environmental, social, and economic threat. There have been a number of regulatory attempts to alleviate these challenges, including the European WEEE Directive, introduced in 2003 and revised in 2012 with the aim of maximising the recovery of valuable resources through reuse and recycling, and reducing environmental impacts caused by inappropriate treatment, littering and leakage into nature.

The Directive requires each country to collect 85% of waste generated at dedicated collection facilities (or 65% of put on market volumes). According to a recent study by the United Nations Institute for Training and Research (UNITAR)16, Norway separately collects around 70%-80% of its WEEE. It is therefore non-compliantn with the Directive, but is nevertheless one of the leading European countries in terms of WEEE collection. However, this means that 20%-30% of WEEE is not collected via the formal system, representing a leakage in the system and reducing the probability of material recovery.

The main reasons for leakage are:

- Norway having a large informal sector, which accounts for around 20% of the leakage, involving the theft of WEEE from collection points which is then typically exported illegally, predominantly to Eastern European and African countries15.

- Industrial cables remaining uncollected at end-of-life due to the high costs of recovery.

- Incorrect disposal of WEEE in mixed waste, which significantly reduces the chance of recovery.

It is also likely that collection rates are even lower than estimated in this study given that the data on theft is highly uncertain and could be significantly underestimated, particularly for higher value small items such as mobile phones, which also typically have the highest of plastic content.

Despite its comparatively well-established collection network, the Norwegian EEE plastic system is 69% linear with less than 1% of WEEE reused and 30% of WEEE plastics recycled annually.

Following collection and sorting, WEEE undergoes disassembly and depollution share, shredding and mechanical sorting in specialised treatment facilities. Recycling of WEEE plastics is a well-established part of the treatment process, with sink-float tanks used to separate and sort polymers and to remove and selectively treat plastics containing brominated flame retardants listed under the European POP (persistent organic pollutant) and REACH legislation which cannot be put back on the market. There is

also no recycling of certain polymers, such as PVC, due to additive content and/or a lack of market for recyclates. This leads to average yields of around 60%-70% 17.

Repair and reuse of EEE is currently an underutilised opportunity. Today, many goods are discarded despite being fully operative or easily reusable if fixed. There is also no system in place to identify and recover reusable products once they are collected as WEEE. Therefore, there is great potential for scaling the secondhand market in Norway by creating demand for secondhand products and establishing a collection system able to separate reusable goods.

Current WEEE regulations lack focus on the recovery of plastics and upcoming policy could even risk a reduction in plastics recycling from WEEE.

The WEEE Directive focuses primarily on collection and overall material recycling rates but lacks focus on the recycling, reuse or recovery of plastics from WEEE. There is even a risk that upcoming policy will have adverse effects on plastics recycling from WEEE due to more stringent constraints on POPs, which could be detrimental to WEEE plastics recycling. Furthermore, there have been signals indicating the potential removal of large industrial equipment and large industrial cables from the Norwegian WEEE Directive as these are not included in the EU WEEE Directive.

Other key circularity barriers beyond the lack of regulation, the technical challenges associated with POPs, and the lack of control over WEEE include:

- A lack of design for recycling of EEE, specifically with regards to plastics.

- Many polymers are still being used which are not recoverable by current sorting techniques due to overlapping densities with polymers containing substances of concern.

- The use of additives and composite materials that alter the densities of polymers, making sorting challenging.

- The high level of heterogeneity of WEEE plastics, with a varying composition of polymers from sample to sample raising the cost of recovery and lowering the yields achieved.

- Relatively low costs of disposal compared to the costs of mechanical sorting and recycling, creating incentives to landfill or incinerate the plastic components rather than recycle them.

- Low quality of recyclates leading to downcycling, mainly for lower value applications such as outdoor furniture and plant pots17.

Achieving Circularity:

Stimulate reuse, standard designs, and design for recycling

Through the combined deployment of circularity levers, circularity levels could increase to 87% by 2040 (63% without chemical recycling), and the reliance on virgin production could be reduced to 43% of total demand, down from 95% in 2020.

The most important upstream lever for increasing circularity is applying design for recycling principles.

Many Original Equipment Manufacturers (OEMs) are committing to ambitious targets for recycled content, meaning that there is significant potential to create closed loops in the sector and short loop plastics from products back including to the same producers.

Examples of companies that have set such targets include Phillips, which aims to reach 7,600 tonnes of recycled content by 2025, as well as Apple, Sony, LG and Logitech.

An estimated 80% of the environmental impact of a product is determined at the design stage18. Adopting design for recycling principles is therefore key both to ensuring recyclability and to meeting the feedstock requirements needed to scale recyclate markets and meet the industry’s recycled content targets.

Design for recycling of plastics in EEE involves simplifying and standardising the polymer mix, shifting to polymers which are more commonly recycled by WEEE recyclers, and avoiding the use of additives (particularly those which have a high chance of being regulated in the future) or hazardous substances18. On a higher level, design for recycling of EEE also requires the long-term standardisation and stabilisation of product design to prevent users having to retire and replace functioning products before their end-of-life. Steps towards standardisation are already being taken, with Norway following the EU’s decision to standardise the plug type for eight product categories by the end of 2024.

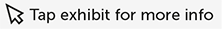

EXHIBIT 17

Through the application of circularity levers the Electronics & Electricals sector can reach 87% circularity by 2040

The potential for reduction of plastics in EEE is limited to around 12% relative to the baseline demand projection for all categories except industrial cables19.

Dematerialisation strategies in EEE are multifaceted and current trends already indicate a movement towards, for example, more compact devices, an increased use of cloud computing, and device consolidation where a single device could be used to provide many services. By leveraging these shifts, it is estimated that 10% of plastics in current consumer-facing EEE can be eliminated.

There are five major downstream levers that should be prioritised in the short term to ensure higher rates of mechanical recycling.

Maximising formal collection of WEEE should be the first priority. It is the most impactful lever in the short term and is critical for gaining greater control over WEEE and avoiding adverse environmental impacts, particularly in other countries.

The Norwegian system currently faces three main collection challenges: theft at collection points, incorrect disposal in mixed waste, and industrial cables being left underground and never recovered. Overcoming these

challenges, particularly theft at collection points, requires much more stringent enforcement of existing policy.

Incorrect disposal has declined as a result of information campaigns from the PROs (Producer Responsibility Organisations) and the introduction of take back schemes in Norway. While this has been particularly effective for higher value items, progress has stagnated recently and incorrect disposal rates have plateaued, with lower value items still being incorrectly disposed of.

Financial incentives and disincentives, particularly deposit return schemes and fines, can reduce incorrect disposal to much lower levels. In fact, by leveraging these opportunities, incorrect disposal could be minimised to 2% by 2040.

EXHIBIT 18

The highest impact levers for the Electronics & Electricals sector are Mechanical and Chemical Recycling

There is existing policy in Norway mandating that old cables are removed, but extracting them is a costly process. Through better enforcement of this policy, removal rates could increase from around 60% to 90% by 2040. However, it is important to consider that it is not always technically feasible to remove old cables, nor always better from an environmental perspective.

Reuse is a very underutilised opportunity; many products are discarded prematurely, indicating significant potential for reuse. However, most reuse is likely to occur abroad.

There is significant opportunity for collected WEEE products to be refurbished and resold for further use, but there are two major challenges.

Firstly, the lack of demand for second-hand products in Norway, both for lower value products due to the low cost of replacing items with new products, as well as for higher value products where there is not the same level of guarantees as there are for new products. Secondly, on the supply-side, there is a lack of focus at collection points on identifying items that could be refurbished and reused.

Reuse initiatives are beginning to emerge in Norway, particularly involving B2B companies taking in used PCs, for example 3step IT. Norway is setting itself up to be a leader in this space, with the establishment of Ombrukt AS (a subsidiary of the Consumer Electronic Trade Foundation) to establish an approval scheme for the reuse of consumer electronics being a key example. After associated companies sort, test, clean, and if necessary, repair products at approved repair centres, they are registered in a Nordic database for reused products and sold in the market by approved Ombrukt-partners. All the products are sold with a warranty to provide extra security for consumers20.

Furthermore, to stimulate reuse, some stores like Power and Elkjøp have introduced take back schemes, offering consumers a small sum in return to spend on their own products in the store. This means the stores manage the economics of collection and reuse, not the EPR systems. WEEE reuse also has the potential to employ 10 times more people per tonne of material processed than recycling activities21.

Adoption of advanced sorting technologies is required to help overcome current technical challenges.

Many plastics –such as PA, PMMA, and PC – are lost under today’s technologies, which rely on material density to distinguish plastics, as they have the same density ranges as plastics with brominated flame retardants. Innovations are required to increase recovery of these polymers, many of which are already underway but require the right resources (time, know-how, capital) and the formation of alliances with both producers and recyclers. Good examples of such alliances is the work delivered by the Poly-CE project, which resulted in guidelines for and from recycling18, and the ongoing NONTox project. Such innovation processes typically take five years or more.

Another example of innovative technologies being tested and scaled is the sorting line provided by Belgian company, Advanced Design of Recycling Machines (AD REM), and German company Hamos, which has already been deployed in the UK and Japan. The process involves two float-sink tank stages, to recover the polyolefins, as well as electrostatic separation to separate the PS and ABS. Investment in scaling these advanced technologies as well as in further R&D is critical and should be supported by policy, for example by setting recycled content targets and material-specific recycling rates.

Mechanical recycling capacity should be expanded to support the 220% growth in recycling needed to cope with the much larger volumes of waste. However, many facilities in Norway typically operate at only 60%-70% capacity due to unfavourable economics. With higher recyclate prices, and greater demand for recyclates, recyclers will be incentivised to maximise their capacity utilisation factor. In addition, extra capacity must be built, either within Norway or in collaboration with neighbouring countries, to meet the 36,000 tonnes of mechanical recycling required for WEEE plastics by 2040.

Finally, chemical recycling should tackle plastics which are unsuitable for mechanical recycling, particularly those which contain brominated flame retardants, as well as plastics from old industrial cables. While chemical recycling is a nascent technology, requiring more research, it is expected to play an important role for WEEE plastics under the System Change Scenario, with 23% (~17,000 tonnes) of demand for utility chemically recycled by 2040 and recirculated back into the system.

EXHIBIT 19

Key recommendations per actor

RECOMMENDATIONS

The Electronics & Electricals sector should prioritise four main actions:

- Standardised design for recycling principles, including recycled content targets.

- Implementation and scale up of rental and second-hand business models.

- Introduction of regulatory requirements to control the whereabouts of WEEE at end-of-life, including the separation of functional products at collection points to enable reuse.

- Scale up of advanced sorting technologies.