These coastal landscapes hold four times more carbon than rainforests, and are vital for biodiversity, food security and protection from rising sea levels.

Jennifer Ring explains how investing in regenerative businesses can keep these ecosystems intact.

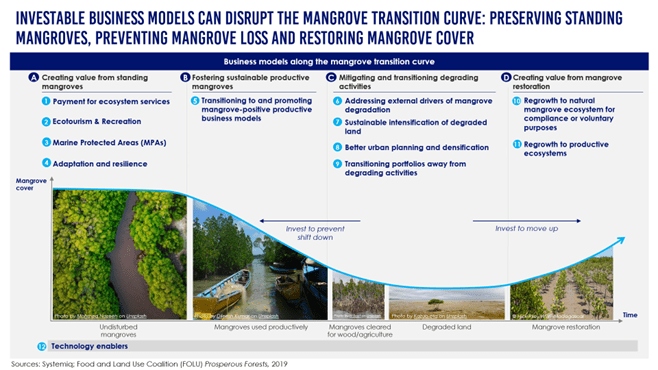

On the eve of the Summit for a New Global Financial Pact, Systemiq launched the Mangrove Transition Curve, a framework mapping the landscape of mangrove-positive businesses models.

Sustainable, productive and regenerative businesses have a vital role to play in creating the mechanisms and incentives for conservation and restoration of these crucial ecosystems. By identifying these investment opportunities, the Mangrove Transition Curve provides the analytical underpinning to unlock private investment at scale.

Why mangroves matter

Mangroves are coastal forests, thriving in salty sediments on the shores of more than 100 countries. They are also an extraordinary nature-based solution. Mangroves are highly effective carbon sinks, sequestering up to four times more carbon than rainforests. They protect coastal communities from storms and rising seas, avoiding around $65 billion of damage each year. Mangroves are also a haven for biodiversity and a critical asset in the looming food security crisis: 80% of the global fish catch relies on healthy mangroves.

Despite the ecosystem services they provide, mangroves are under threat. More than 25% of forests have been lost or degraded – coastal development, conversion to farmland and aquaculture are the main human causes. Action and investment are urgently needed, but projects face a massive funding gap: SDG14 Life Below Water the least invested of all the SDGs.

The Curve is already being used to support the work of the Mangrove Breakthrough with the UN Climate Change High-Level Champions and the Global Mangrove Alliance as well as the Sustainable Markets Initiative’s Financial Services Task Force.

So how does it work?

Archetypes A and B focus on creating value from intact mangroves – with the creation of livelihoods a critical feature of these models to ensure incentives are in place for local people to keep mangroves healthy. Archetype C, by contrast, identifies business models that mitigate external drivers of degradation (such as pollution), or that encourage more efficient use of land to prevent further deforestation.

While these models point to the emergence of a new nature-based asset class of regenerative, mangrove-positive investment opportunities, stronger market, policy and fiscal support is needed to sustainably scale these efforts.

The Mangrove Transition Curve takes a systems-lens to tackling barriers to investment. It indicates a suite of potential solutions to unlock capital for mangroves including:

- Aggregate to get scale: Designing aggregation mechanisms/funds to package and finance small-scale projects to attract larger investors.

- Replicate to build track record: Scale what works to build real proof points and deepen market expertise & track record around innovative financial solutions such as blue bonds and mangrove insurance.

- De-risk to mobilise private capital: Develop fit-for-purpose blended finance instruments which tackle key counter-party or technology risks specific to mangrove-positive business models.

- Enabling environment to bring certainty: Targeted policy solutions which reduce real and perceived country, technology and investor risks.

- Equity to improve outcomes: Take a people-centred approach to scaling solutions which prioritises the jobs, health and agency of local communities who depend on and steward mangrove ecosystems to ensure long-lasting, demand-driven outcomes.

The key takeaway - a new nature-based asset class

“The Mangrove Transition Curve shows that mangroves can be an investable asset class. A diverse set of regenerative business models that protect and restore these critical ecosystems already exists. What’s more, the emergence of innovative financial mechanisms like nature-based insurance, blue bonds and blended finance vehicles can scale and accelerate investment in these businesses.

Taken together, the foundations are in place to secure the future of mangroves, generate real financial returns, and strengthen the resilience of coastal communities that depend on them”